MacIver News Service | December 18, 2015

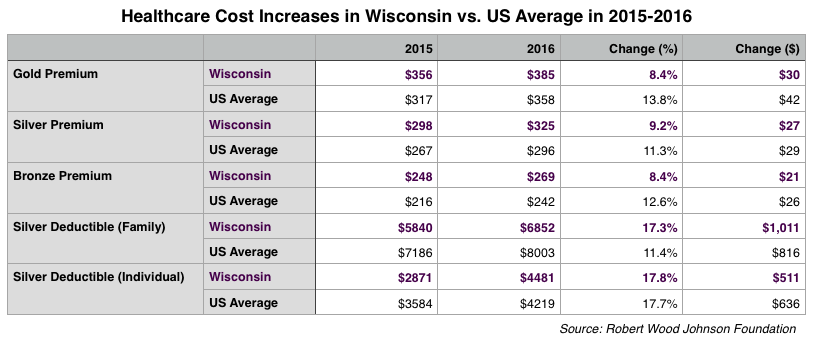

[Madison, Wisc…] The average price of healthcare premiums and deductibles in Wisconsin will rise by an average of 8.4 – 9.2 percent in 2016, according to new data released this week by the Robert Wood Johnson Foundation. The price increases in Wisconsin are consistent with a nationwide trend, with premiums for silver-level plans expected to jump an average of 11 percent over the next year. It is the only publicly available dataset showing average state-by-state costs on the Affordable Care Act (ACA), or Obamacare, exchanges.Premiums for gold and bronze plans will jump 8.4 percent in Wisconsin, according to the new data. Silver plans will also be more expensive, increasing from an average monthly premium of $298 in 2015 to $325 in 2016.

Annual deductibles will have even larger increases depending on the type of plan. Individuals on the silver plan will see their deductibles increase an average of 17.8 percent – from $2871 in to $4481 to annually. Deductibles for family silver plans will rise an average of 17.2 percent, from $5840 in 2015 to $6852 in 2016.

The MacIver Institute has been reporting on the economic effects of Obamacare for years. Most recently, a MacIver News Service report showed that Wisconsin residents shopping on the Obamacare exchanges will see higher prices and fewer choices.

The cheapest plan in the state will be an individual catastrophic level plan in Columbia County that costs $118.97 a month, with a $6,850 deductible and $6,850 maximum out of pocket. The most expensive plan is the Anthem Blue Cross and Blue Shield Gold DirectAccess, a Multi-State Plan in Jackson County for a family with an adult over the age of 50 and at least 3 children. That plan costs $3,417.98 a month, with a $2,000 deductible and $13,700 maximum out of pocket. The premium costs alone add up to over $40,000 a year.

More information about the latest dataset is available here.