MacIver Institute | September 25, 2017

Read the MacIver Institute’s complete analysis of the 2017-2019 budget here.

It was 2 1/2 months overdue, but the 2017-19 Wisconsin state budget (2017 Act 59) is now in the books.

While the process was delayed and, at times, not pretty, the 2017-19 budget is a good budget. Not a great budget, but a good budget.

Any time a government votes to eliminate a tax, that is a significant taxpayer victory. Significant because it happens so rarely. If we eliminate a tax, it makes it more difficult for our government to take our hard-earned money from us in the first place. The only way we taxpayers are ever going to make headway in our effort to limit the size and scope of our government is if we restrain and then reduce the amount of tax dollars going to fund our government. Wiping a tax completely off the books is a positive step towards getting the government we want.

The 2017-19 budget signed by Gov. Scott Walker last week eliminates not just one tax but two taxes. Gone, too, is an entire big-government program – the Local Government Property Insurance Fund – that has been a part of state government since the 1900s. The 1900s. We would, at this point, give you some example of what life was like back in the 1900s to drive our point home, but it is so long ago that we can’t.

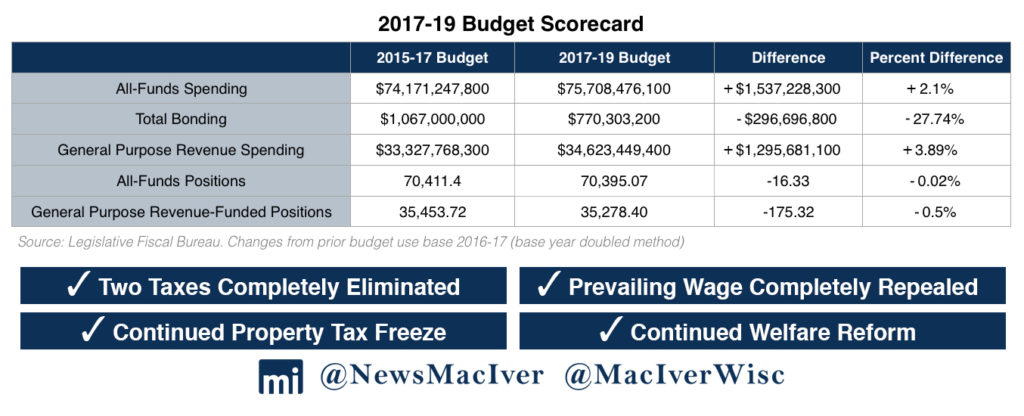

While spending increases in this budget, the final document cuts government positions. The Joint Finance Committee deserves kudos for that. It trimmed 432 more positions than Walker’s original budget plan. Ultimately, the budget eliminates 16 jobs total from all funding sources compared to the 2015-17 spending plan, but to get there it cuts 175 positions from General Purpose Revenue (GPR) and moves 498 state posts to Program Revenue-funded positions. That’s important. GPR is drawn from the general tax base, reliant on taxpayers. Program Revenue is funded specifically by those who use a particular government service.

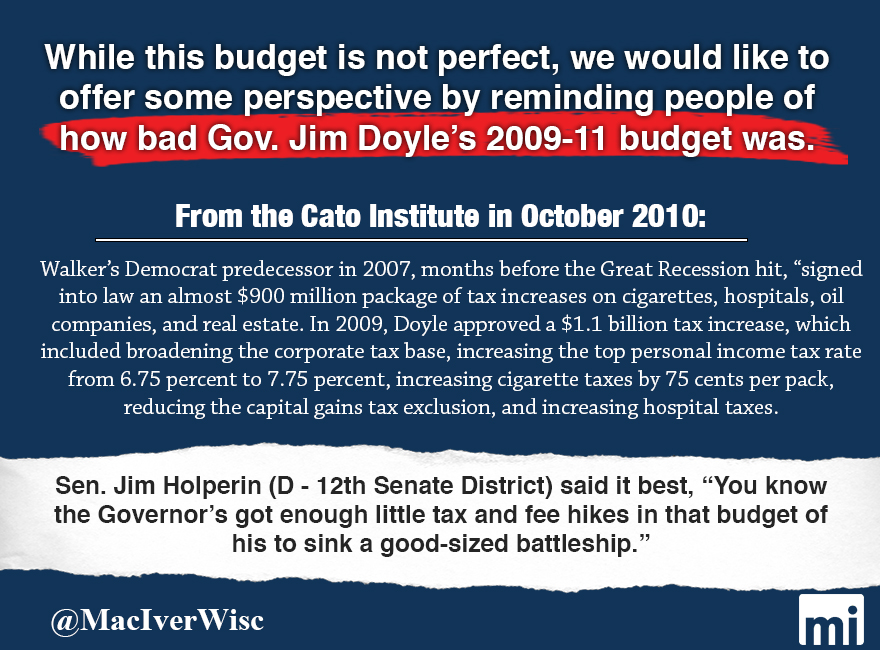

And we would be remiss if we didn’t remind taxpayers just how truly spoiled we are today here in Wisconsin. It wasn’t that long ago that we, as taxpayers, were constantly under siege from Madison, bombarded with one new tax after another, followed by another tax increase. At times we may be frustrated with some of the ideas coming out of Madison, but we must remember how much better taxpayers have it today compared to just seven years ago.

So we need to take a second to celebrate the fact that, once again, Gov. Scott Walker kept his pledge to not raise taxes. No individual income tax increase, no corporate tax increase, no sales tax increase. No gas tax increase or general vehicle registration fee increase. Another statewide property tax freeze on top of all that to boot. Thank you, Gov. Walker.

And thank you, Republican-controlled Legislature for trimming nearly a half-billion dollars out of the original budget proposal.

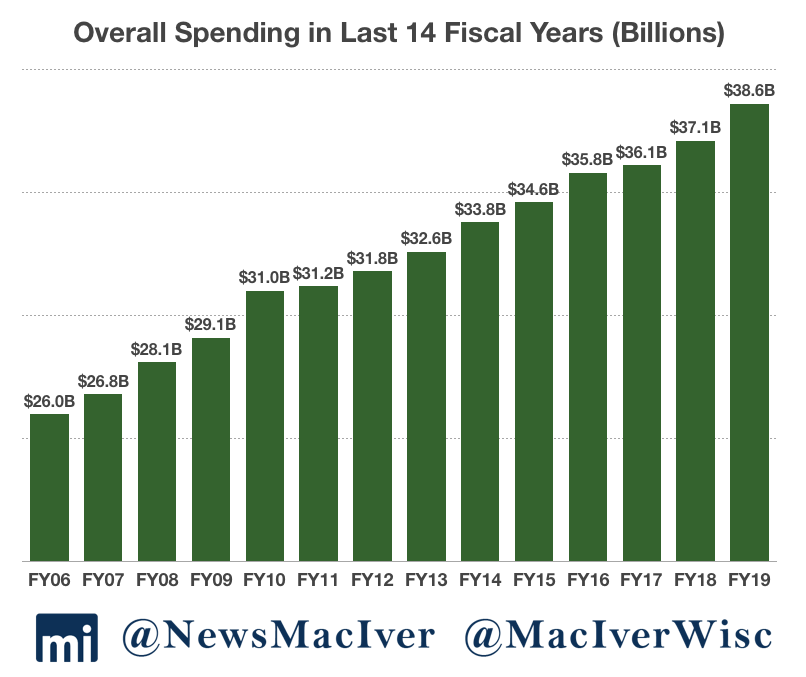

That is NOT to say that this is a perfect budget. Far from it. The spending increase in this budget is too big. We hope the governor and legislators next time will put the time and effort into writing a state budget that fundamentally reorganizes state government, shrinks the footprint of the bureaucracy and actually spends less of our taxpayer money to provide only the vital services everyone needs.

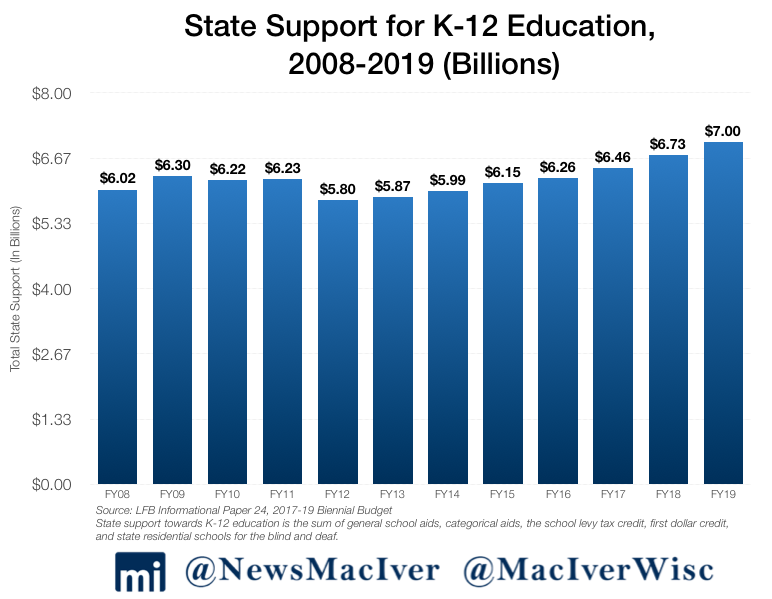

We can’t help but feel that the $636 million increase in state aid to K-12 education was a missed opportunity to drive further reform of our education system and push our schools to do a better job of educating all of our children. It is morally reprehensible that we allow more than 52,000 children to be trapped in failing schools and that we would choose to give failing educrats a reprieve rather than give the students stuck in bad schools immediate access to a school of their choosing.

Thankfully, the governor did make this budget significantly better with the use of his veto pen. Gone is the troublesome language that would have given the tyrannical power of eminent domain to the non-elected quasi-government agency called the Public Financing Authority. Gone is the new bureaucracy at the Transportation Projects Commission. Gone is the unnecessary prevailing wage repeal start date delay, so taxpayers will soon begin to see significantly lower costs for government building projects. Also gone is $2.5 million to once again study and pursue tolling for our road system. Enough with the studies. If you think tolling is the right thing to do and the answer to our so-called transportation funding problems, introduce a bill and vote on the idea. Everyone knows what tolling is, no need to waste more money analyzing the concept.

Technically due on July 1 (the beginning of the state fiscal year), Walker made it official and signed the budget document on September 21st.

Reform Dividend

Walker rolled out his budget blueprint in February, heralding a budget plan built on the “Reform Dividend.” Six-and-a-half years of “common sense conservative reforms,” the governor said, have cleaned up the fiscal mess Republicans inherited in 2011, put the state back on the path to prosperity, and eased the tax burden on overtaxed Wisconsinites.

So Walker tapped into those dividends in laying out his $76.1 billion spending plan, $34.5 billion of that from General Purpose Revenue (GPR). That was an increase of 2.6 percent (base year doubled) and 1.3 percent (base spending) over the 2015-17 budget. The governor’s proposal called for $37.5 billion in spending in 2018 and $38.6 billion in 2019, including GPR, federal revenue, segregated funds and program revenue.

While mostly warmly received by Republican lawmakers, some fiscal hawks expressed concerns about the increased spending in Walker’s plan: $375 million in the first year, and $1.18 billion in the second year. Using Madison math, or the base year doubled method, that equates to a 2.6 percent increase compared to the last budget.

Education

As promised, the governor came through with a generous increase in education spending. So generous, in fact, Department of Public Instruction Superintendent and potential 2018 gubernatorial challenger, Tony Evers, praised Walker’s plan as a “pro-kid budget.”

The 12-member Republican majority on the Joint Finance Committee approved an education spending plan that would have spent $639 million over the base, just $9 million less than what Walker had sought. Democrats said the massive increase wasn’t enough, but the final product boosts per pupil aid by $200 in the first year of the budget and $204 in the final year. In the end, the final budget increases state aids by over $636 million compared to current spending. At more than $11.5 billion over two years, the K-12 budget represents the largest state education investment in actual dollars ever.

Walker’s budget originally tied some of the additional per pupil aid to schools with the requirement that school districts certify compliance with Wisconsin’s Act 10. The governor’s proposal would have required districts to show that school employees are paying at least 12 percent of their health insurance costs and 6 percent of their public pensions. The Legislature removed the requirement, but school districts will have to report to the state the details of their employee health plans. That’s a big win for taxpayers. For the first time, the state will begin systematically tracking Act 10 savings.

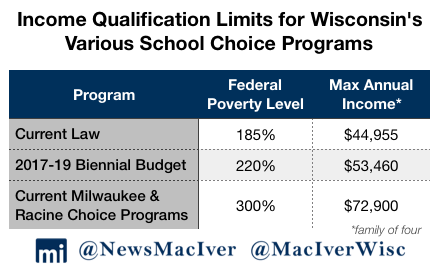

School choice picked up some big wins in this budget. The finance committee upped open parental choice program enrollment by increasing the eligibility level to 220 percent of the poverty level, or about $53,460 for a family of four. Including the public school open enrollment program, about 95,000 students participate in school choice in Wisconsin, with the majority in the southeastern corner of the state.

The budget also removes barriers to the Special Needs Scholarship Program, a new program that allows children with special needs to participate in school choice. The spending plan increases the number of independent charter school authorizers – any UW chancellor and any technical college board will now be allowed to authorize new charter schools. More authorizers should translate to more charter school offerings, which is a victory for parents and students alike.

Walker excised a big education expenditure with his veto pen. The Joint Finance Committee budget called for increases in local property tax funding for low-spending school districts through the low revenue adjustment. Once implemented, that could’ve raised statewide property taxes by up to $23.2 million. The districts have long argued that since property tax limits were implemented in 1993, they have been at a disadvantage because they are now locked into their low spending ways forever.

“I am vetoing this section entirely because the result is a substantial increase in property tax capacity that school districts may exercise without voter input,” the governor wrote in his veto message. “In several school districts that would be eligible to raise taxes under these sections, referenda to exceed revenue limits already failed within the past two years. An increase in revenue authority from the state in these districts would circumvent purposeful, local actions.”

Walker used his veto pen to remove legislative language that watered down his change to rules for school districts using the energy efficiency adjustment. This program, established in the 2009-11 budget, allows school districts to increase their revenue limits by the amount they spend on energy efficiency projects. The Milwaukee Journal Sentinel noted that this exemption, the only exemption to property tax controls, has allowed schools to spend over $200 million without voter approval. In February, Walker proposed changing the rules so that school districts would first need to hold a referendum if they wanted to spend over their revenue limits.

Transportation

GOP legislative leadership called the governor’s blueprint a good starting point, and then proceeded to tinker with and try to reshape the budget proposal, particularly on transportation.

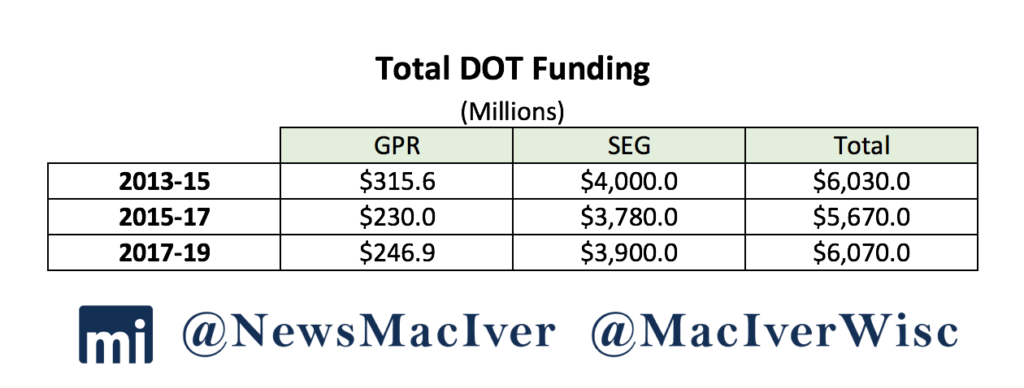

Most Assembly Republicans continue to be unhappy with the level of borrowing used to pay for our transportation needs. When Walker did not propose a gas tax increase or any new transportation funding streams in his budget, Assembly Republicans objected loudly.

In stressing that every funding idea must be on the table in addressing Wisconsin’s disputed $1 billion transportation budget shortfall, Assembly Republicans backed gas tax increases and vehicle fee bumps to generate an enhanced and sustainable flow of revenue. The budget process ground to a halt for over two months.

Let’s be clear. I don’t support spending less on K-12 education than what’s in my budget and I will veto a gas tax increase.

— Governor Walker (@GovWalker) March 30, 2017

In the end, the Joint Finance Committee approved $400 million in bonding, much closer to the original half-billion in borrowing the governor first proposed. The final bonding number got buy-in from a reluctant Assembly in large part because about $252 million of the money would go to the Interstate-94 north-south project, tied to the Foxconn Technology Group incentives package. Lest we forget, the budget was constructed amid a “once-in-a-century” economic development proposal, Foxconn’s plan for a $10 billion high-tech manufacturing campus in southeast Wisconsin projected to eventually create at least 13,000 family-supporting jobs.

To the dismay of southeast Wisconsin lawmakers, the funding package includes no new money for Milwaukee area megaprojects, reconstruction of I-94 between the Marquette and Zoo interchanges and finishing off the north leg of the zoo.

Republicans on a party-line vote did away with what remained of Wisconsin’s Great Depression-era prevailing wage law. Finishing the unfinished business of the last session when the Legislature eliminated prevailing wage for all but state projects, the Joint Finance Committee has saved taxpayers from a system that artificially inflates wages on government building and highway projects. A previous study from the Wisconsin Taxpayers Alliance found that taxpayers could have saved as much as $300 million on 2015 construction projects had the reforms been in place then.

The budget also eliminates 252 Department of Transportation positions, a move that thins a bloated state agency that has wasted so much taxpayer money.

When all was said and done, Walker won the great 2017 transportation battle, holding firm on no gas tax increases or general vehicle fee hikes.

Healthcare

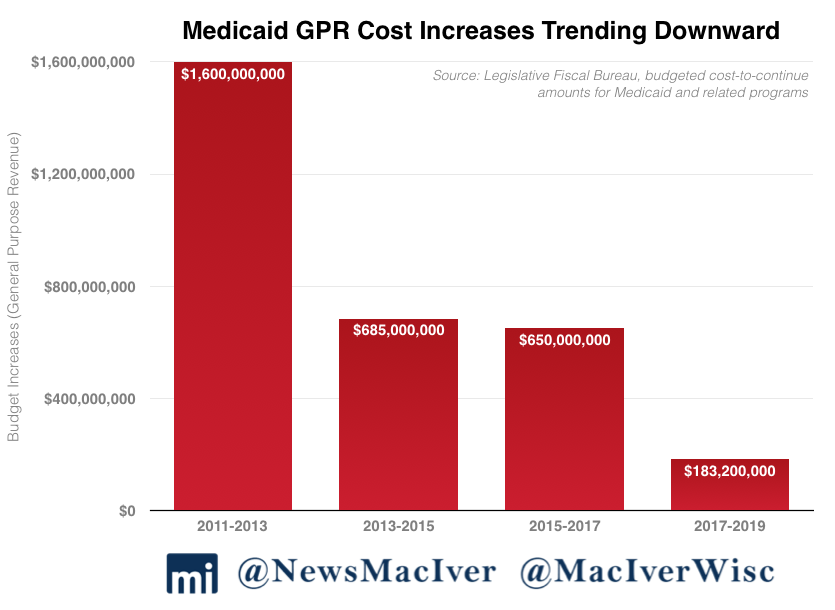

Despite the ever-escalating cost of healthcare in this country, taxpayers here in Wisconsin received some good news earlier this year. Actual Medical Assistance program expenditures during 2015-17 came in at $325 million less than what was included in the previous budget because of lower-than-expected enrollment. Fewer Wisconsinites on MA is a good thing.

In a new round of reforms intended to help transition Medicaid recipients to employment and off government assistance, Walker’s Department of Health Services submitted a broad request to the federal Centers for Medicaid Services in June, asking the Trump administration for permission to implement a variety of reforms to the state’s Medicaid program – also known BadgerCare – including a drug screening requirement.

If approved, it will allow Wisconsin to screen those who apply for BadgerCare for drugs and, if necessary, require participants to submit to a drug test. If a recipient fails, he or she would have to enter a state-funded treatment program. If they refuse, they would be ineligible for BadgerCare benefits until they agree to enter treatment.

Welfare Reform

Walker has made welfare reform a priority throughout his tenure, and this state budget was no different. Pending final approval from the federal government, Wisconsin will become the first state in the nation to screen and drug test participants in the welfare-to-work program. Under this budget, the state will also expand work requirements for benefits programs to ensure that individuals receiving state benefits are building their own skills towards independence.

Drug Testing MA recipients is not cruel as @SenTaylor stated; leaving them dependent on govt without assistance to get off drugs IS cruel.

— Governor Walker (@GovWalker) May 26, 2017

This budget also eliminates a significant benefit cliff in Wisconsin’s child care tax credit program that creates a disincentive for career growth. Under past law, if a recipient of Wisconsin Shares made just $1 more than the income limit, they would be automatically cut off from the program’s benefits. The budget reforms the program, creating a “ramp” to slowly reduce benefits over a certain point. Participants can now take gradual raises or promotions without the fear of losing child care benefits overnight if they make just a penny too much. That’s true reform, and it’ll make a positive impact on peoples’ lives.

Tax Relief

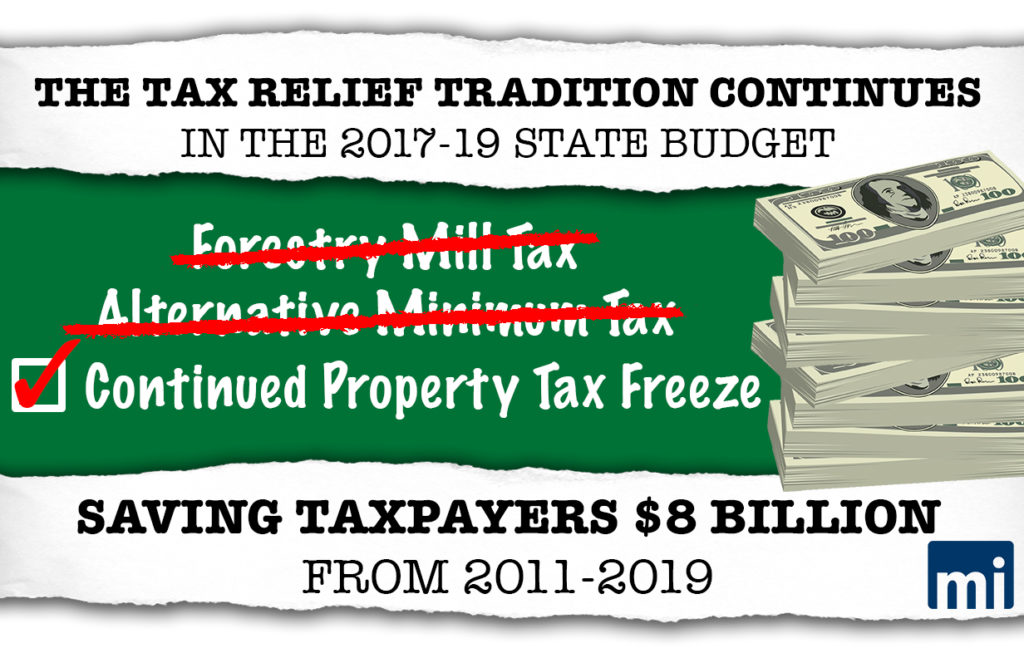

This budget eliminates a tax. Let that sink in. The Badger State, which has long worn the Scarlet T of a high-tax state, has eliminated the state property tax, also known as the forestry mill tax. Taxpayers will save $180.5 million over the next two years, not enough that anyone will be able to retire tomorrow but the powerful symbolism cannot be denied.

“Here in Wisconsin we are not only reducing taxes, we’re eliminating taxes altogether,” Rep. Dale Kooyenga (R-Brookfield), a member of the Legislature’s powerful budget-writing committee said. “You want to talk about history? We’re making history right here.”

Kooyenga also celebrated the end of the Alternative Minimum Tax, a kind of separate income tax that is taking a bigger bite out of middle-income filers. While its impact is smaller, north of $7 million a year beginning in 2019, the principle is powerful: lawmakers really can wipe a tax off the books.

An omnibus tax relief package authored by Kooyenga and Sen. Howard Marklein (R-Spring Green) takes a big bite out of Wisconsin’s antiquated and unfair personal property tax law. Small businesses have long had to pay local government a tax on the value of their equipment. The JFC bill exempts non-manufacturing machinery, tools and patterns from the property tax, unburdening business by a combined $74.4 million over the budget. Democrats criticized the measure as ultimately drawing tax revenue away from local governments that will be forced to do the “same or more with less resources.” The partial repeal initiative, however, will be paid for through the creation of a state aid program administered by the state Department of Revenue.

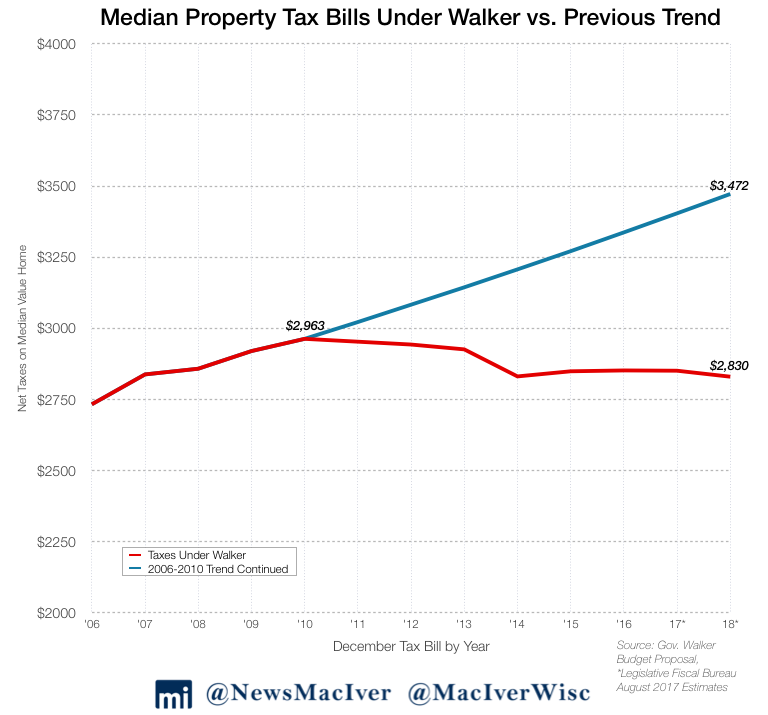

Property taxes, for another two years, are expected to be lower for the typical homeowner in Wisconsin than they were when the governor took office in 2010. That amounts to $3,000 in savings for the owner of a median-priced home in the Badger State compared to the trend prior to 2010, according to the Walker administration.

And by the end of the newly signed budget in 2019, Wisconsin taxpayers will have received some $8 billion in cumulative tax relief over Walker’s tenure in office.

But small business’ gain, in part, was a loss to income taxpayers. Walker’s budget proposal called for $203 million in income tax cuts. He did so by reducing the lowest income tax bracket from 4 percent to 3.9 percent and second-lowest bracket from 5.84 percent to 5.74 percent, while also widening the second-lowest bracket. The tax break would ultimately have benefited all Wisconsin taxpayers, who, regardless of income, pay those rates on at least a portion of their income.

As budget negotiations progressed it became increasingly clear that income tax cuts would have to be sacrificed for other priorities, not the least of which was the personal property tax.

The budget saves money for Wisconsin’s higher education students, too. It extends the University of Wisconsin System instate tuition freeze into its fifth and sixth years. Walker initially had proposed a 5 percent tuition cut, but the Legislature decided the $35 million price tag was too heavy. Instead, they put some of the money into need-based financial assistance.

Walker’s 99 vetoes are expected to save taxpayers a combined $87.5 million over the next two budgets. More important, the governor removed some very unconservative provisions, many of which slipped into the budget at the last minute.

Global Perspective – Is Wisconsin Heading In The Right Direction?

Setting aside the specifics of the state budget for a second, we need to take a step back and ask whether Wisconsin is heading in the right direction.

In May and June, Wisconsin’s unemployment rate hit levels not seen since the latter part of the roaring 1990s.

At 3.1 percent, the state’s jobless rate was at its lowest level in 17 years. While it edged up slightly in July and August, Wisconsin’s unemployment rate was a full percentage point below the national number, which climbed to 4.4 percent. Wisconsin’s labor force participation rate continues to climb, at 68.8 percent in August. That’s nearly six percentage points above the US. rate of 62.9 percent.

The Badger State’s unemployment numbers have dramatically improved in recent years, from a post-Great Recession peak of 9.2 percent in January 2010, the last year of Democrat Gov. Jim Doyle’s tenure.

Initial Unemployment Insurance claims ended 2016 at their lowest level in 30 years, and all signs point to the same this year, according to data from Wisconsin Workforce Development. Continuing unemployment claims ended 2016 at their lowest level since 1973.

While the jobless rate is an important gauge of the economy’s health, it is but one of many. And many of the leading economic indicators have continued to point up through Walker’s two terms in office.

State agricultural exports rose nearly 9 percent in the first half of 2017, tallying $1.8 billion in products shipped to 134 countries, according to the Walker administration. Wisconsin businesses shipped a total of $11.2 billion in goods and services worldwide in the first six months of the year, an 8.2 percent increase over the same period in 2016.

When Walker first took the oath of office in January 2011, he and the new Republican-controlled Legislature faced a $3.6 billion state budget shortfall. Through a series of limited-government reforms and much-needed fiscal constraint, the state’s financial health is in a much improved position. Instead of deficits, the Walker era has been a time of budget surpluses.

The state’s Rainy Day Fund, or budget stabilization fund, stands at nearly $282 million, over 165 times larger than it was when Walker first took office.

Rep. John Nygren (R-Marinette) and Sen. Alberta Darling (R-River Hills), co-chairs of the Legislature’s budget-writing committee, assert that conservative reforms in recent years have put the state in a strong fiscal position.

“The budget we just passed will continue those reforms and help shield taxpayers from economic uncertainty,” the lawmakers said in a statement. “With $280 million in our rainy day fund, an additional $14 million in increased revenue, and setting aside nearly $200 million in ending balance of the budget, our careful budgeting will help ensure our great state continues to prosper and succeed.”

Wisconsin’s fully funded public pension system helped push the state to the fourth best spot nationwide in overall long term debt obligations, according to a report last year by the Pew Charitable Trusts. About 4.8 percent of combined annual income earned by Wisconsinites would cover the obligations the state owes to creditors. Compare that to the national average of 14.8 percent, or in Illinois’ case, 31.7 percent.

Last month, Moody’s upgraded Wisconsin’s long-term debt to its highest level since 1973.

Wisconsin’s General Obligation rating is now Aa1 – the second highest rating, just below Aaa.

“The bottom line is, that is good for every taxpayer because it means our financial house is in better shape, and it means long term, it actually costs us less to borrow,” Walker told MacIver News Service.

“That’s just a sign that what we’ve done over the last six years is working,” Walker said. “We’ve shown that common sense conservative reforms work.”

A steadily growing economy, prudent budget management, and a fully funded pension system were key reasons for the upgrade.

“The upgrade to Aa1 reflects the proven fiscal benefits of the state’s approach to granting and funding pension obligations when many other states are experiencing stress from rising costs and heavy liabilities; an economy that delivers steady but moderate growth; conservatively managed budgets; and adequate liquidity,” according to Moody’s report.

Walker critics point to job creation numbers in the governor’s tenure, keying in on his pledge that Wisconsin’s economy would create 250,000 jobs in his first term in office. That didn’t happen, for a variety of reasons, not the least of which was the record slow rate of U.S. economic recovery from the recession late last decade.

The bigger problem of late is not a lack of job opportunities, but the region-wide challenge of finding skilled workers.

“The problem six, seven years ago was we didn’t have any jobs,” the governor told reporters in May. “The challenge we have today is, we have so many jobs, we don’t have enough people to fill those.”

As Walker likes to say, Wisconsin is open for business. And businesses have taken note.

Chief Executive magazine rates Wisconsin as a top 10 state to do business. Not long before Wisconsin’s conservative revolution in 2010, the nation’s top chief executives ranked Wisconsin as one of the worst states for business, a state laden with high taxes and stifling regulation.

One Fortune 50 company in particular has taken notice.

In late July, Walker joined President Trump, Speaker Paul Ryan (R-Janesville), and Sen. Ron Johnson (R-Oshkosh) for a White House announcement that Foxconn Technology Group planned a massive investment in southeast Wisconsin. The Taiwanese tech giant rolled out a proposal to build a Liquid Crystal Display production campus, a city unto itself, that would eventually create 13,000 manufacturing jobs paying on average $53,000-plus per year. Officials say the $10 billion investment would spur 10,000 construction jobs and many thousand more spin-off jobs to serve this “once-in-a-century” economic development project. Wisconsin beat at least six other states bidding on the project, with the Legislature officially signing off on a $3 billion incentives package this month. Foxconn expects to break ground in spring.

“This is a truly transformational step for our state, our people and our economy, and Wisconsin is ready,” Walker said in signing the Foxconn legislation.

This is a good budget. In the main, it’s good for conservatives. It’s good for taxpayers. It’s good for Wisconsin.

Property taxes, on a median home value basis, are lower. Two taxes are gone altogether. The burden of government has been lifted in part off the backs of business and taxpayers. By the measures of limiting government and making life better for the Wisconsin taxpayer, this budget gets the job done.

Read the MacIver Institute’s complete analysis of the 2017-2019 budget here.