[bctt tweet=”Racine’s “transparency” initiative was never more than a misleading smear campaign against #SchoolChoice, but Gov. Tony Evers’ budget would expand that initiative statewide. #wiright #wipolitics” username=”MacIverWisc”]

[bctt tweet=”Racine’s “transparency” initiative was never more than a misleading smear campaign against #SchoolChoice, but Gov. Tony Evers’ budget would expand that initiative statewide. #wiright #wipolitics” username=”MacIverWisc”]

School choice information on property tax impact was inaccurate and wrong

The “transparency” initiative was never more than a smear campaign, but Gov. Tony Evers’ budget would expand that initiative statewide

April 9, 2019

By Ola Lisowski

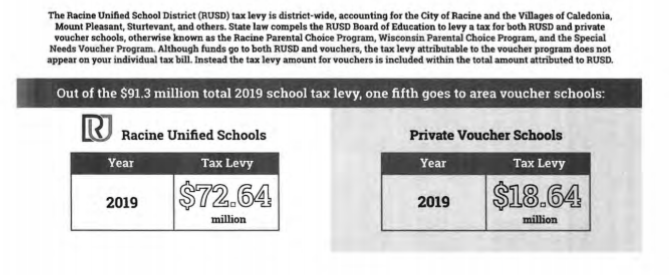

Recently, the City of Racine sent out property tax bills to homeowners, as it does every year. This year, however, a new insert was included with the annual bills. That insert claimed that one-fifth of Racine’s property tax levy goes to private voucher schools. It’s inferred that property taxes have increased and that fewer dollars are flowing to public schools because of the area’s parental school choice program.

“Opponents of school choice want children to stay in low-performing schools or schools that can’t meet a student’s learning needs. They have long tried to muddy the waters on the costs to taxpayers. Most recently, Racine city officials misled the public, sending inaccurate information on school choice along with local tax bills.” -Speaker Robin Vos

As Assembly Speaker Robin Vos wrote in a Sunday editorial in the Racine Journal-Times, the information in these flyers is incomplete and deeply misleading. The city lied to taxpayers under the guise of transparency, when really, the effort was little more than a smear campaign dedicated to spreading misinformation about the Racine Parental Choice Program (RPCP).

What’s more concerning, Gov. Tony Evers’ biennial budget proposal would have municipalities statewide include such information on local property tax bills. If municipalities across the state follow the Racine model of providing incomplete information to local property taxpayers, it will set a bad precedent for honest tax reporting. Ultimately, this effort amounts to a coordinated, intentional effort to mislead taxpayers and rally opposition against choice programs.

Above: the misleading insert included with Racine property tax bills this year

Wisconsin’s school finance formula is notoriously complicated, which works to the Racine Unified School District (RUSD)’s advantage. After all, who questions the validity of anything included in their property tax bills? They might question why they have to pay that money, but it’s rarely a consideration that a figure itself is factually wrong.

Yet, the figures used on the “transparency” insert are wrong in a few ways.

How Racine only showed one side of the equation, fleecing taxpayers and blaming choice

When a student leaves a public school (in this case, RUSD) to attend a private choice school, the district gets what’s called an equalized aid reduction for the value of the departing student. That’s the number the insert focuses on – but only showing this side of the equation seriously misleads the public. It’s misleading because it never shows the many other ways that the school district receives money for students who leave.

Racine Unified’s budget financially benefits from the choice program in a number of ways. When a student leaves Racine Unified for a private choice school, the student is still counted in Racine Unified’s enrollment count, which is based off of a three-year rolling average. The district receives money for students that they do not educate in the form of generalized aid. In total, 1,783 students who do not attend Racine Unified are included in the public school district’s membership count thanks to three-year rolling averages. In other words, state taxpayers pay Racine Unified for 1,783 students that do not physically attend their schools.

Right now, state taxpayers pay Racine Unified for 1,783 students that do not physically attend their schools thanks to the three-year rolling average.

That’s one of the dirty little secrets about school finance that much of the public doesn’t know about. Racine and other public school districts get to count students they’re not educating in their membership totals, and they get $13.5 million in generalized aid for those students. The insert makes no mention of this fact — likely because this initiative was never about transparency.

The insert claims that one-fifth, or 20 percent, of Racine’s property tax levy goes to private schools. This is the only part of the equation that the insert shows. It does not show the many ways in which that dollar amount is offset, such as the fact that Racine Unified also includes a large portion of choice students in the parental choice program and special needs scholarship program in their membership count.

According to a January LFB memo, the actual property tax levy for private choice schools is actually 5 percent. Racine Unified chooses to levy property taxes to the maximum allowable amount, or $18.64 million for parental choice and the special needs scholarship programs together. But they also receive $13.5 million more in general school aids because of the parental choice program. There is no mention of that in the insert. The LFB hones in on the larger of the programs, parental choice, which has a levy impact of $18.3 million.

“Because RUSD levied to its maximum under revenue limits and thus fully used this revenue limit adjustment, its levy was increased $18.3 million,” the Jan. 31 LFB memo states. “Second, RUSD was able to include a portion (1,783 of 3,242) of the choice program pupils in its membership under general school aids, so that its general school aid was $13.5 million higher than it otherwise would have been, compared to a scenario where RUSD could not include those pupils in membership. As a result, if you include the effects of this additional membership, the net change to its property taxes was an increase of $4.8 million.”

All told, the revenue limit increase, or property tax impact, for the Racine choice program is $4.8 million, rather than $18.3 million, according to LFB. The insert claims that school choice’s impact on property taxes is 289 percent higher than it really is.

The insert also claims that RUSD is “compelled” to raise property tax levies. The word “compelled” makes it seem that the district is required to raise taxes accordingly, another subtle way the insert misleads the public. The school district is, by law, allowed to raise its levy — but nowhere does the law say the district must do so. The insert infers that raising taxes is simply out of the city’s hands. It’s another subtle way Racine lays blame at the foot of the choice program while trying to wash its hands of any wrongdoing.

All told, the revenue limit increase, or property tax impact, for the Racine choice program is $4.8 million, rather than $18.3 million, according to LFB. The insert claims that school choice’s impact on property taxes is 289 percent higher than it really is.

From the taxpayer’s perspective, districts shouldn’t be allowed to levy millions of dollars, if any at all, for students they’re not educating.

In addition, all of the students attending parental choice are low-income. That makes Racine Unified’s overall count of impoverished students higher than it actually is. It is true that the majority of Racine choice students would be likely to attend Racine Unified if the choice program didn’t exist, but the fact remains that they currently do not attend public schools. It is another way that choice financially benefits Racine Unified, as the district receives more per-pupil resources for every student. Not only does Racine Unified bill the taxpayers for students they’re not educating, the district receives more in per-pupil funding for all of their students thanks to school choice.

The insert also leaves out the fact that the state reimburses choice students at lower levels than public school students. That saves taxpayers a lot of money.

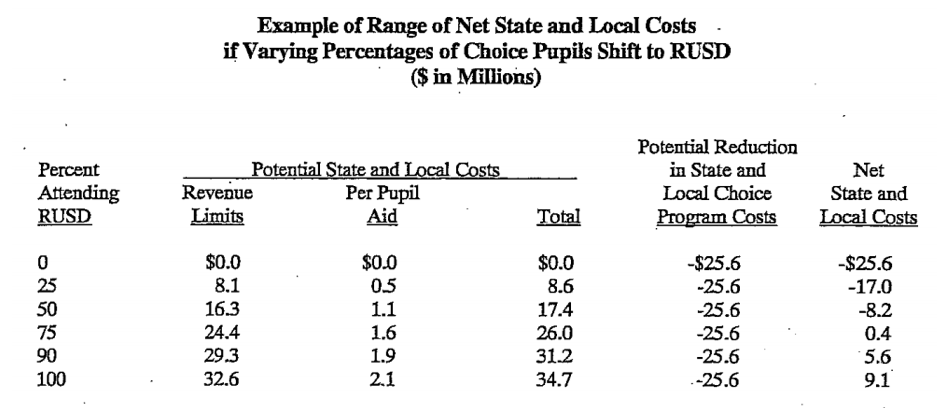

If the Racine choice program was eliminated and every single student went to Racine Unified instead, property taxes would actually increase. In fact, if choice didn’t exist in Racine at all, property taxes would be $25.6 million higher than they are today, according to another LFB memo.

LFB’s memo states that “the potential effect of eliminating the Racine choice program on net state and local costs ranges from a reduction in net costs of $25.6 million if no choice pupils attend RUSD to an increase in net costs of $9.1 million if 100% of choice pupils attend RUSD.”

The tax insert clearly sets out to mislead the public by claiming that property taxes would be lower if not for the choice program. As LFB shows, that’s false.

None of that is to mention the fact that Racine’s choice students see higher academic performance than traditional public school students. Why was such information left out? It’s a simple matter of politics.

.@SpeakerVos reacts to the City of Racine’s smear campaign against choice schools, where it sent false information to property owners about the programs impact on taxes. #WIright pic.twitter.com/4ysD6y8q4t

— MacIver News Service (@NewsMacIver) April 9, 2019

A convenient scapegoat

While Racine Unified has faced academic and financial woes in recent years, it has looked for a scapegoat upon which to lay the blame. That’s where Racine parental choice comes in.

Choice programs are a way for low-income students to attend private schools on a voucher. These are students who cannot afford private school on their own, but for a variety of reasons, aren’t happy — or successful — in traditional public schools.

Created in 2011, Racine parental choice has been remarkably popular among participating families. This year, enrollment reached 3,241 students, a more than 15-fold increase from the program’s first year, when 212 students participated.

That’s a problem for Racine Unified, which has seen declining enrollment for years. The parental choice program is a direct competitor to the traditional schools, since it’s no longer a given that families without the personal wealth to attend private school will choose Racine Unified. In response, RUSD has launched what amounts to a smear campaign, using public dollars for a “transparency” initiative that uses some very flawed numbers.

Taxpayers deserve to know the truth, and Wisconsin’s children deserve better from the public school advocates who will lie to force those children back to public schools.

Jim Bender, President of School Choice Wisconsin, wrote that the “use of erroneous and incomplete data [show] the true nature of the flyer — advocacy.”

“Nowhere does the flyer reflect the lower cost per student for those in the RPCP or the impact if the program were eliminated. As more information becomes available, other school districts around the state should ensure their information and data are correct and complete.”

Vos’ editorial ends with a similar conclusion: “With the increased popularity, a track record of success and cost savings, there’s no reason to freeze school choice or continue a misleading, taxpayer-funded campaign against it,” Vos writes. “We all want our kids to succeed. Let’s hope in the future we use facts to prove our beliefs and not just misleading opinions.”

Requiring that municipalities include inserts like these in their property tax bills isn’t the only way Evers’ budget attacks school choice, either. Evers would also freeze enrollment in the choice programs and bar new students from using the special needs scholarship at all.

“Transparency” is one of those phrases you can use to justify a lot of things. What if a transparency initiative was never about transparency in the first place? In the end, Racine’s effort to “educate” the public was little more than an organized attack on the choice program and increased educational options. Taxpayers deserve to know the truth, and Wisconsin’s children deserve better from public school advocates who will lie to force those children back to public schools.