The State Budget is On Deck: Expect Big Spending and Big Tax Hikes

COVID Slush Funds Just Whetted Big Spenders’ Appetites; Skate Parks & LGBTQ Kids Library Collections Don’t Come For Free

This week we heard the inauguration speeches from elected leaders as they were sworn in.

Astute taxpayers might have sworn a bit themselves as they listened, because it is clear that government’s greedy eyes are squarely focused on raiding family budgets to fund a hike in already historically high government spending.

As Governor Evers laid out his broad priorities – specifics would be unusual in an inaugural address – there was nothing really new. He wants to:

- “Fully Fund” schools

- Recruit more teachers

- Attract more workers

- Legalize abortion

- Invest in transit and transportation “alternatives”

- Legalize marijuana

- Expand affordable housing

- Invest in local governments

Like Evers’ state of the state address last year, his remarks were perhaps most remarkable for what was not mentioned – crime. An issue that was pivotal in the fall election and promises to take center stage during the spring elections, the high violent crime rate has Wisconsinites feeling less safe in their communities. In Milwaukee, the homicide rate in 2022 is more than double that of 2019.

The speech made clear one thing: he wants a much, much bigger government, and he thinks he has the mandate to do it.

Higher local government taxing and spending is an Evers priority, and one he telegraphed in the campaign. Big government proponents have long complained about levy limits, the inability of local governments to enact unlimited property tax hikes and lack of shared revenue boosts, but in light of the billions of pandemic dollars flowing into local government coffers it’s cause for concern to see the issue gaining traction more broadly. This spells trouble for Wisconsin’s hardworking taxpayers.

Wisconsin has always relied more heavily on property tax revenues than other states. But when property taxes were skyrocketing in the late 70s through the early 90s, the state agreed to take on ⅔ funding of schools while restricting the levy (limiting the amount property tax collections could go up.) The goal was to stabilize property taxes and stop unfettered local spending from taxing people out of their homes. And it was necessary: the annualized average property tax levy increase was more than 8% between 1975 and 1991.

Shared revenue is one mechanism by which the state provides funding for local governments. It was cut under Governor Doyle in 2004 by about 8% and again in 2010 by 3%. In 2012 under Governor Walker, there was another 8% cut which was offset by provisions in Act 10 allowing local governments to reduce their costs. Since then, Shared revenue has been essentially frozen. While it’s still a huge state program, shared revenue accounts for a smaller proportion of total state spending than in the past.

Tax Hell

It as with good reason Wisconsin was known for decades as a “tax hell.” The state has made substantial strides in decreasing the overall tax burden, particularly the property tax burden. Wisconsin is still above the US average in property taxes per $1,000 of personal income: in 2018 we ranked 17th, down from 9th in 2010, down from 4th in 1970.

The side effect of fiscal responsibility is that elected officials who love to spend other people’s money and bureaucracies chafe against limitations. There are constant cries from local units of government, lobbyists, and fiscal liberals that the government has been starved of cash.

It’s simply not true.

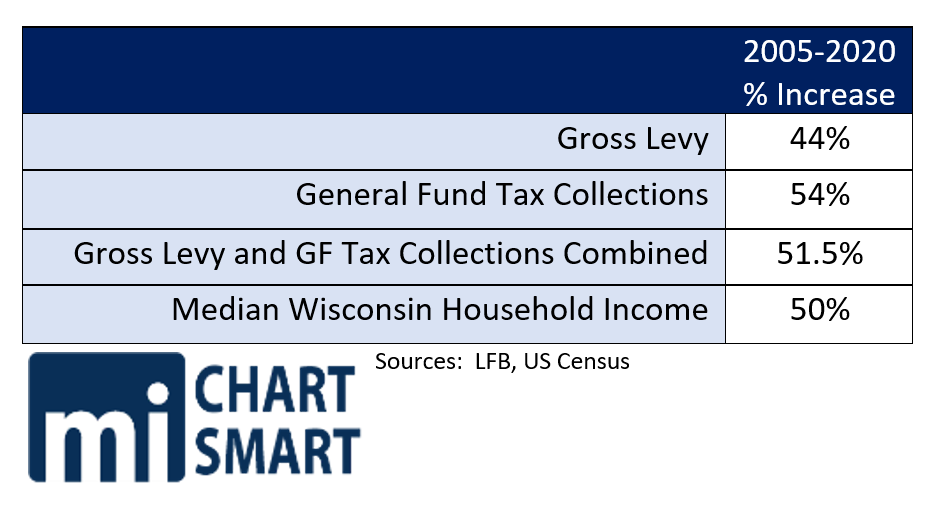

Department of Revenue data shows the state’s gross property tax levy has increased 44% between 2005 and 2020. This is with all the supposedly onerous levy limits and spending restrictions in place. During this same timeframe, 2005-2020, general fund tax collections increased 54%. The gross property tax levy is about 30% of the total amount of general fund collections, and combined, the gross levy and the GPR collections increased 51.5% in this period.

During this same timeframe, the median household income increased 50%, not quite enough to keep up.

So while it is true that the property tax levy increased more slowly than GPR collections, it has continued to increase substantially. And let’s not forget the underlying point: the intent of controls on local units of government was to limit their ability to tax and spend to levels taxpayers could afford. Limits aren’t a problem, they’re a solution.

Only in government is a policy that works as intended targeted for elimination.

And in fact, the gross levy figures understate the increase in funds available to locals, because they do not account for the tax shifts that have reduced the property tax levy while shifting the burden to the general fund. For example, in recent years, the state has instituted the following tax shifts which have reduced the property tax levy without reducing Wisconsinites’ overall tax burden:

- Shifted about half the funding for the Technical College System to GPR, reducing their levy and thus the overall levy by hundreds of millions of dollars.

- “Eliminated” the personal property tax, by shifting it off the property tax levy and onto the general fund.

- “Eliminated” the forestry mill tax from the levy by shifting the burden to the general fund.

All of these tax shifts resulted in effectively invisible decreases to the gross levy which camouflage the true level of levy increases. (Lack of transparency is one more reason tax shifts do ill by taxpayers.)

Similarly, the gross tax on a median value home increased 5.5% from 2010 to 2019, while state tax credits – school levy credit, first dollar, and lottery – increased 35.7%.

Efforts made over time to control the rate of local tax and spending increases have worked to slow the rate of increase as they were intended to do. But make no mistake, they’re still increasing at a fine clip.

Unsurprising Vultures

With a huge budget surplus, it’s no surprise that the big-spending vultures are circling.

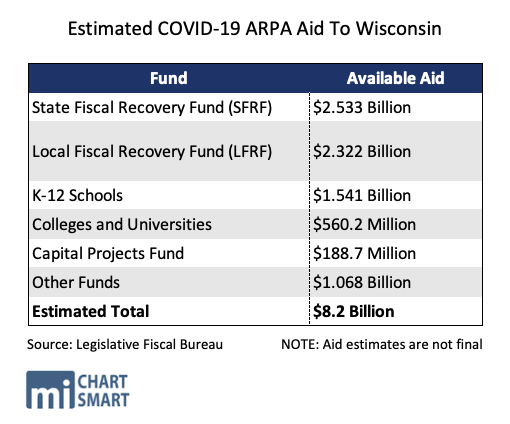

It’s no surprise that the administration favors increasing the tax burden and continuing the spending spree they’ve been on. The Evers Administration has had billions of federal stimulus dollars to hand out, local governments have gotten windfalls directly and indirectly from the federal government.

It’s no surprise that, using Madison math, locals who have had billions dumped into their coffers are crying poverty. It’s not surprising that they’ve irresponsibly committed so many of these one-time funds to ongoing positions and projects that they don’t need and won’t be able to fund once the covid monopoly money runs out. It won’t be surprising when the wails of poverty reach fever pitch when the “free” money runs out and the locals begin claiming they’re suffering from dire and extreme budget cuts and need more cash from taxpayers.

It’s no surprise (to those who fight for small government taxpayers can afford) to see some of the unnecessary and wasteful uses local governments have chosen for their covid slush funds. Under pressure to commit the funds and – one could argue not really short of cash to begin with – they are throwing money at wish lists:

- Wauwatosa is receiving $24 million in ARPA funds, and among their priorities for the money are:

- $272,000 for the public library to broaden their “Equity Collection” and purchase materials responsive to disparities. A specific focus is children’s materials by and featuring LGBTQ+ people, to allow children “to see themselves reflected in books”

- $555,000 for a new social worker to “forge deep and dependable relationships” in the community

- $4,000,000 to implement priorities for parks, trails and open spaces.

- Eau Claire is receiving $13,529,002 in ARPA funds, and the wish list they’re funding includes:

- $492,835 for a building inspector

- $530,088 for a network engineer

- $475,503 for an ARPA coordinator

- $291,876 for a half-time Equity, Diversity and Inclusion coordinator because the current coordinator needs more help in “facilitating a community-wide and resident-experience informed process of community change related to the well-being of children, adults and families”

- Wausau is receiving $15.7 million in ARPA funds. Their wish list included a quarter million for “communication and public education” for a solar array, which has not been approved yet, though these items have:

- $225,000 for a skate park

- $500 grants for closing costs for only those homebuyers who take government-designed “homebuyer education” prior to making an offer

It is important to note that there are challenges local governments, particularly in rural areas, face.EMS and paramedic support is one of those challenges, and Eau Claire allocated just $100,000 of their $13.5 million to training paramedics. That’s about one-fifth the amount they’re spending on one new “ARPA coordinator” whose job is to look for state and federal funds to continue the new spending when the money runs out. Yes, they created a new government-funded position to look for more government money to sustain new, ongoing programs they created with buckets of money they knew was one-time. In other words, local governments have decided to treat the windfall of COVID cash as just part of a new, high base. While bemoaning their poverty.

In the real-life demonstration of what real local governments would do with a real lot of money, real needs took a back seat to real big, ongoing, real unnecessary spending.

It’s not surprising that with unprecedented COVID slush funds driving unprecedented spending and unprecedented growth in government, most local governments (and school districts) are hurtling toward a fiscal cliff of their own irresponsible creation while simultaneously insisting they need more.

Surprising Vultures

What is surprising that with steadily increasing levies, GPR tax collections so high that we have a $6+ billion surplus, and after billions of stimulus funds poured into the state, much flowing into local coffers, that the big-government, big-spenders have gained so much traction in the legislature.

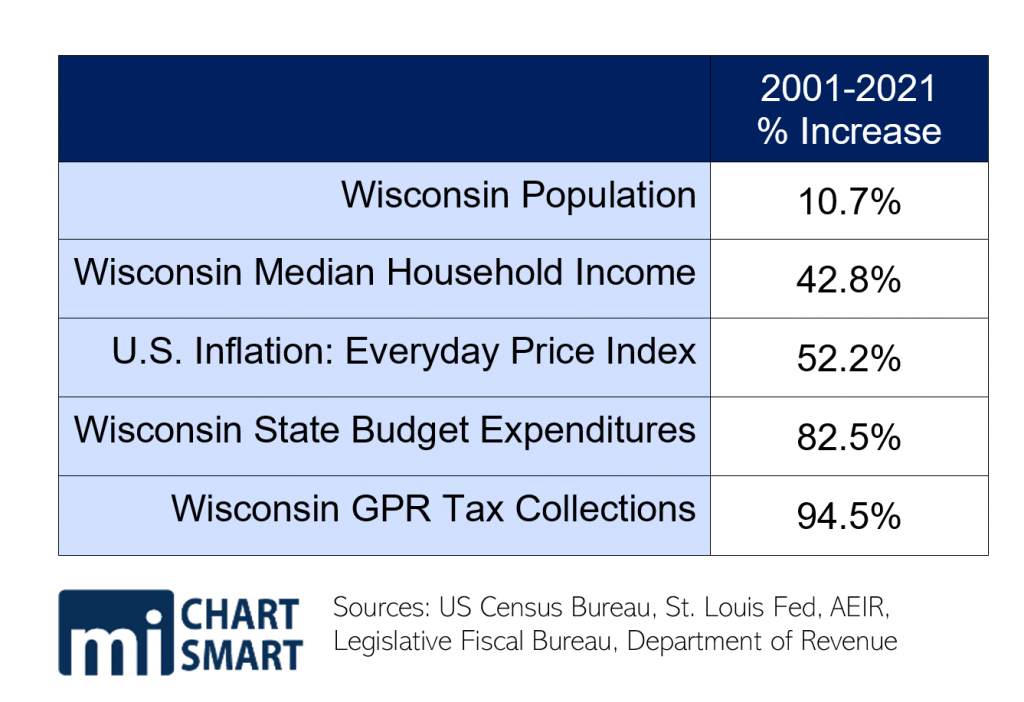

It probably should not be a surprise. As we have reported, state government spending, even under many years of Republican leadership, has outstripped income growth and inflation – the only thing that grew faster than spending has been our GPR tax collections.

Do we really need higher property taxes, higher spending, and bigger government?

Between 2011 and 2021, 36 (2%) of Wisconsin’s 1850 municipalities have had levy exemptions related to referenda. Similarly, there have been 4 of 72 counties (5.5%) with levy exemptions. This does not indicate broad taxpayer belief that their local governments are suffering from too few tax dollars. Nor does it show that taxpayers won’t OK a referendum if they see a need.

Allowing property tax hikes will have long term consequences for rural representatives. Property tax hikes hit seniors on fixed incomes hard, and in Wisconsin, rural counties have higher proportions of elderly residents, and the rural elderly demographic is set to grow substantially in the coming decades. This population does place increased demand on services, and those growing needs deserve attention from the legislature. Giving locals more money and more taxing authority when they’re focused on bigger children’s LGBTQ+ library collections, funding “restaurant weeks” and skate parks would reward irresponsibility and double down on unneeded spending.

Front of mind for fiscal conservatives going into this budget cycle should be that while government is impacted by inflation, so too are families. Taking more taxes from already strained family budgets so local governments – who have bulked up on diversity staff and open spaces plans – have more to play around with is neither conservative nor responsible.

And all this is just a warmup for 2026 when the COVID slush funds run dry. If ever there were a time to draw a line in the sand against higher taxes and spending at the local level, it is at this juncture where, beneficiaries of an unprecedented slush fund, locals are dumping money into skate parks, LGBTQ children’s books and new Equity, Diversity and Inclusion government employees.