As Governor Evers starts his second term in Madison, The John K. MacIver Institute for Public Policy turns our attention to the upcoming legislative session, the 2023-2025 state budget, and what should be done with the $6.6 billion in “surplus” tax revenue.

While Gov. Evers and his special interest allies will dream up countless new ways to spend your hard-earned tax dollars and continue the massive growth in government, The MacIver Institute has put together an agenda that puts you, the taxpayer, first, promotes economic growth, gives our children a world-class education, protects your God-given liberties, and bridles government at every level.

Our 2023 Agenda focuses on these critical areas:

- K12 Education

- Crime and Justice

- Tax Policy

- Election Integrity

- Welfare Reform

- Government Accountability

- Healthcare Reform

We have put together an extensive list of policy recommendations – a list we expect to grow over the session – to improve your life by limiting the size, scope, and cost of your government. If you have more freedom and if you keep more of your own money, we believe prosperity for all will naturally follow, and we will all help build a better Wisconsin for generations to come.

Let’s be clear. The “surplus” is your money. It is not the government’s slush fund or an opportunity to build more and bigger bureaucracies. While we have made some progress on tax relief in recent years, the surplus is proof that Wisconsin taxpayers have been taxed too much for too long.

Now is the time for real and substantive tax reform. Now is NOT the time for tax shifts, new unnecessary government programs, or another explosion in bureaucratic spending.

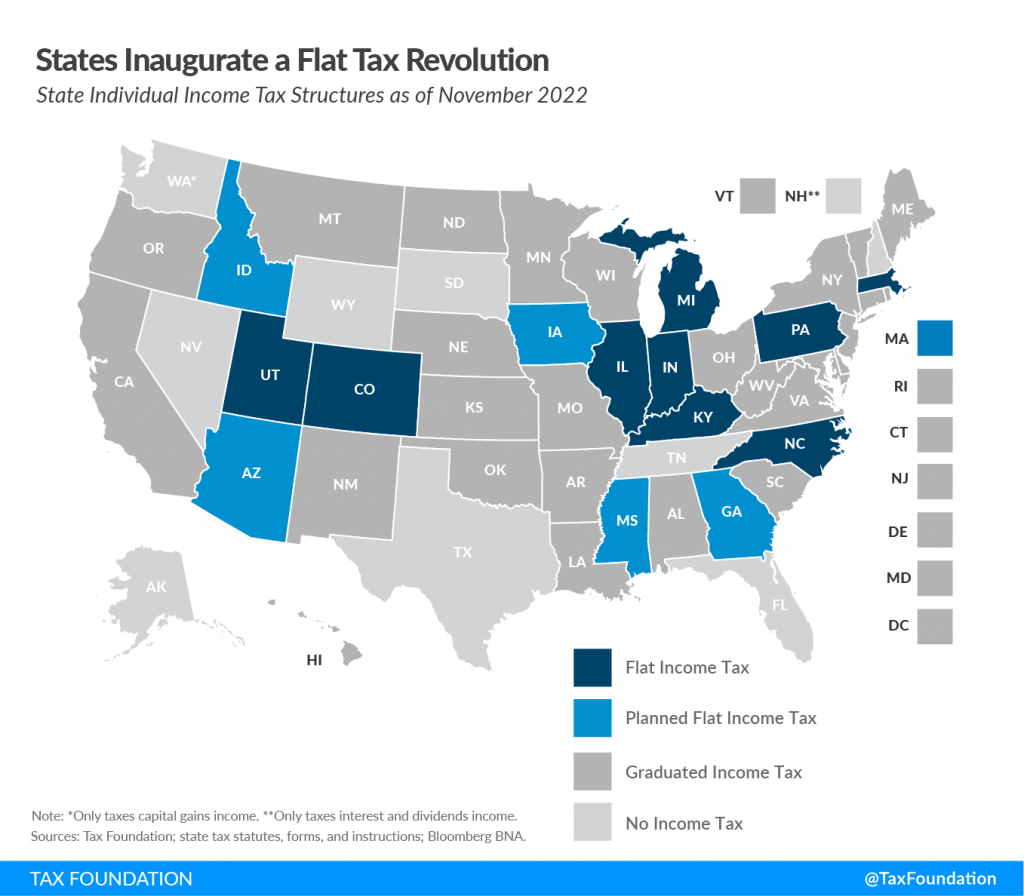

Now is the time for a flat tax.

While a 3% flat tax will give you the much-needed tax relief you deserve and force the politicians to decide what critical government services benefit all of us, our reforms do not stop there.

Wisconsin needs to stop the radical extremists from poisoning our children’s minds and, instead, make our schools focus strictly on academic mastery, not indoctrination.

We need to rein in problematic bureaucrats and rogue agencies so each and every one of us can pursue the American Dream, free of interference from those who supposedly work for us.

We need to end the liberal’s scold-and-release efforts so dangerous criminals are locked up, making our families safe again.

We need to force the able-bodied to work, so all are self-sufficient and we can strengthen our safety net for those truly in need.

We need to address healthcare provider shortages, so we all have access to care when we need it.

We need real and greater transparency at every level of government and across all agencies to put taxpayers back in charge.

We need election-day-only voting and other safeguards to protect our cherished one-person, one vote democracy.

While the challenges we face here in Wisconsin are many, we believe the answer should never be more government or less freedom for you and your family. Please join the MacIver Institute as we continue our fight for a better Wisconsin and a better tomorrow for everyone.

K12 Education

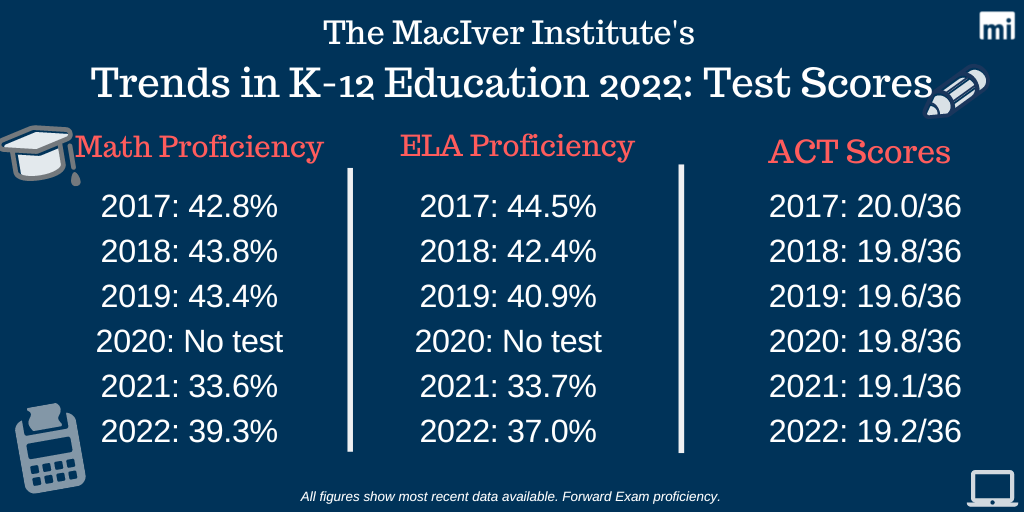

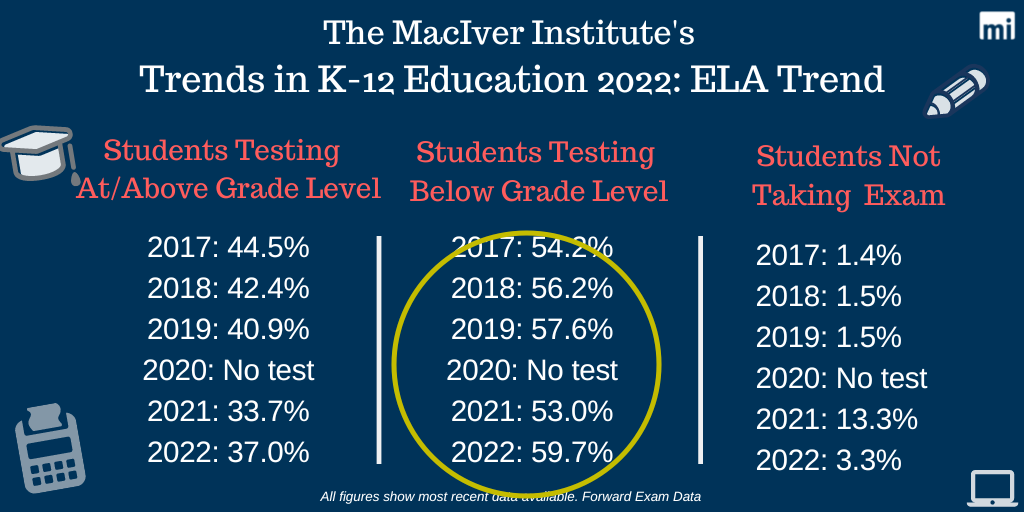

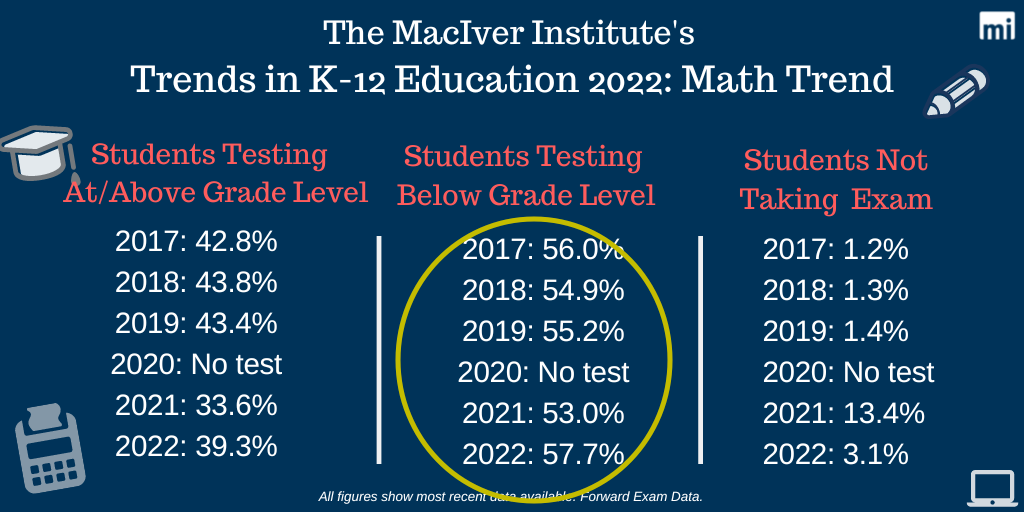

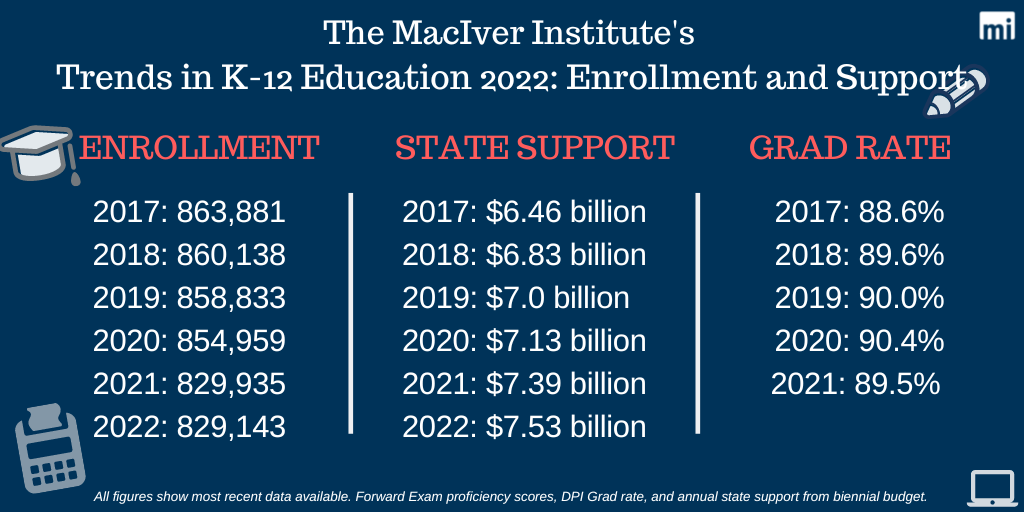

In spite of declining numbers of students and continued increases in funding, testing shows that just over one-third of students are able to perform at grade level in English and Math. And to cover up this wholesale failure, DPI has rigged school report cards to show only 4% are failing, insisting everything is great, and if only granted unlimited resources, things would be even better.

It’s not surprising that students are suffering in the basics when from top to bottom, educrats are more interested in pushing things like CRT, gender liquidity, and anatomy denial than academics – all while denying their focus has shifted from education to indoctrination.

But student test scores tell the truth.

To get back on track, we need to get back to basics, ensuring schools are responsive to taxpayers and students learn the fundamentals.

- Restoring Parents’ Rights

Evers’ veto of the Parents Bill of Rights showed clearly how far the education establishment will go to shut out parents. This bill should be a top priority for the new legislature. - Choice For All

Educational choice should not be limited by geography. With so many public schools pushing political ideology and rejecting parent involvement, every parent should be able to choose the school that is best for their child. - Real Report Cards

Nearly two-thirds of students are failing, but the DPI says only 4% of schools are. We should return to A-F grades, make the metrics meaningful, weight achievement, and require schools to prominently post their grade on their website and in all external communications. - Refocus on the 3Rs

Future success of every student depends on proficiency in basic subjects, something public schools are failing to provide. It’s time to scale back bloated administrations, require schools to spend more of their budgets in classrooms and focus on academics, not political or gender activism.

Social promotion and grade inflation should be banned. And in schools with low proficiency, instructional hours should be increased with core subjects the only focus. - Transparency

Curriculum, lesson plans, and homework assignments should all be online and easily accessible to the public. DPI should be forced to collect and make easily accessible to the public, uniform and detailed data from schools on revenue, administration and spending. - Referendum Reform

Schools complain about asking taxpayers for money, but they’ve turned referenda into a racket. They spend tax dollars to campaign and market tax-and-spend referenda, with little transparency, oversight, or reporting. We need comprehensive reform restoring integrity to the process. - End CRT-based Teaching

Educators mock parents opposed to CRT in schools, saying it’s “too advanced to be taught,” while using its principles to teach children they are racist. It’s time to ban the use of racist CRT principles in our schools.

Crime and Justice

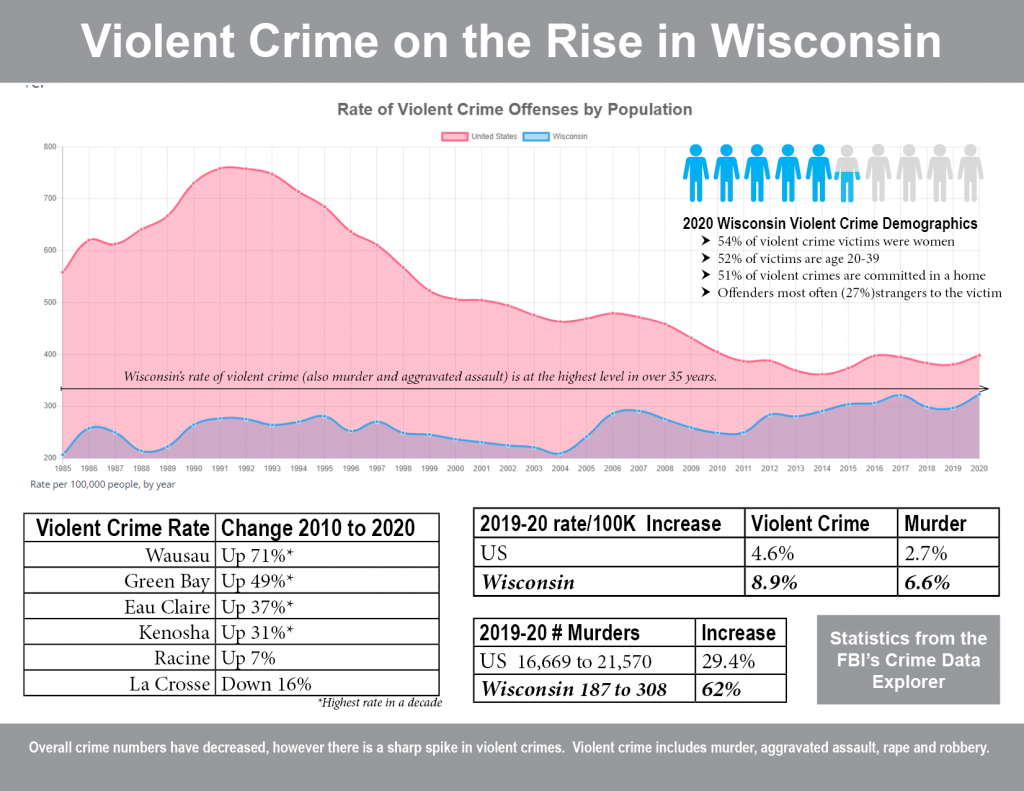

Rogue prosecutors and Scold-and-Release policies have predictably resulted in a huge spike in violent crime; Milwaukee leads the nation. DAs and judges across the state routinely refuse to prosecute, dismiss serious gun charges, and release dangerous criminals with low- or no bail. And over the past 4 years our Department of Corrections has worked to let felons back on the streets without requiring them to abide by the terms of their supervision as they complete their sentences.

Meanwhile, efforts to improve transparency and accountability are ignored in favor of spending more on ‘education’ programs for prisoners who, data tell us, will be back in prison in short order. It’s time to abandon Scold-and-Release and make public safety the priority.

- Rein in Rogue Prosecutors

Across the nation, prosecutors charged with keeping neighborhoods safe are refusing to prosecute criminals and releasing them from custody on low- or no bond. This drives the violent crime rate up.

We have a process for removal of rogue prosecutors, but it’s not enough. We need to roll back prosecutorial and judicial discretion and provide legal repercussions for those in the justice system who pick and choose which laws to enforce. - Bail Reform

We need to tie bail amounts to potential danger to the community and institute mandatory minimum bail for certain crimes. - CCAP Expansion

It’s time to stop hiding information about bail, plea bargains and sentencing, because judges and DAs object to the public learning about their record. CCAP should be broadened to provide more transparency into our justice system. - Reform Release Policies

The other side of the coin is the corrections system. In the past few years, we’ve seen our prison population reduced about 15%, and hundreds of discretionary paroles including murderers, rapists, and child molesters.

Evers’ Department of Corrections has turned a blind eye to felons who violate conditions of their release. Rules surrounding extended supervision, probation and parole policies must be reevaluated, strengthened and enforced. - Rights Restoration

Fines, fees, restitution and any other conditions imposed by the court should be considered part of the sentence, and rights restored only after payment in full. Felons convicted of murder or rape, and those convicted of 2 or more violent felonies should have their rights restored only by a 2/3 vote of the legislature.

Tax Policy

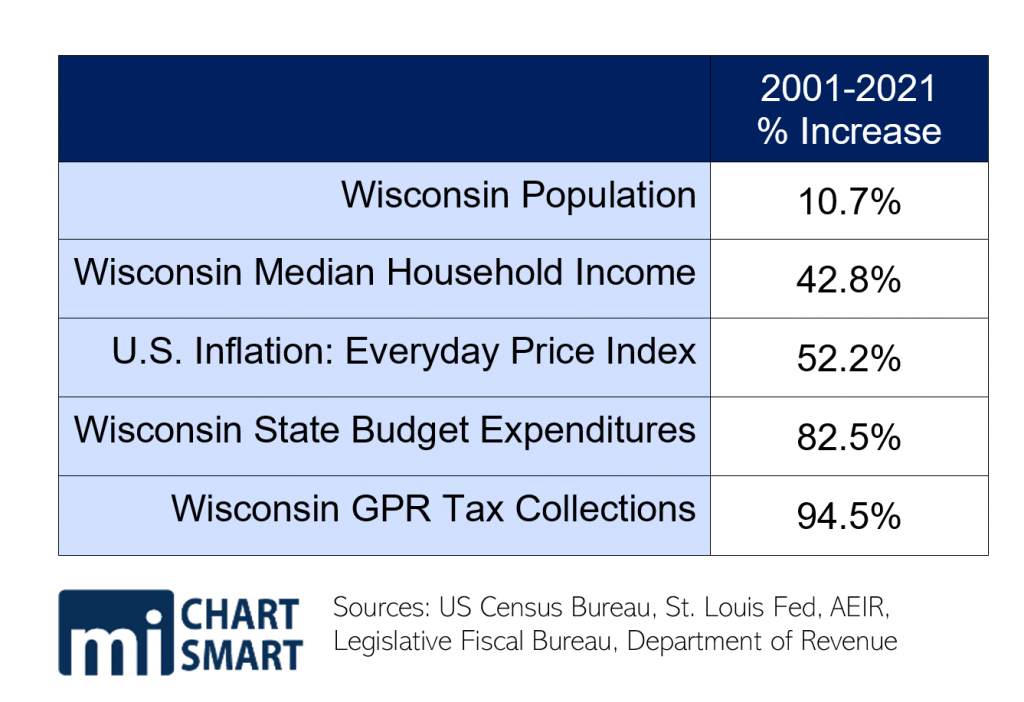

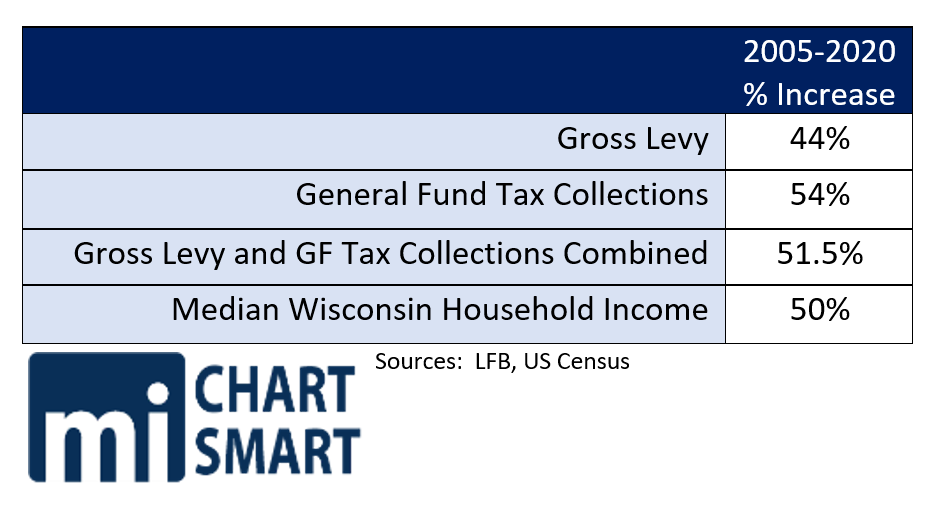

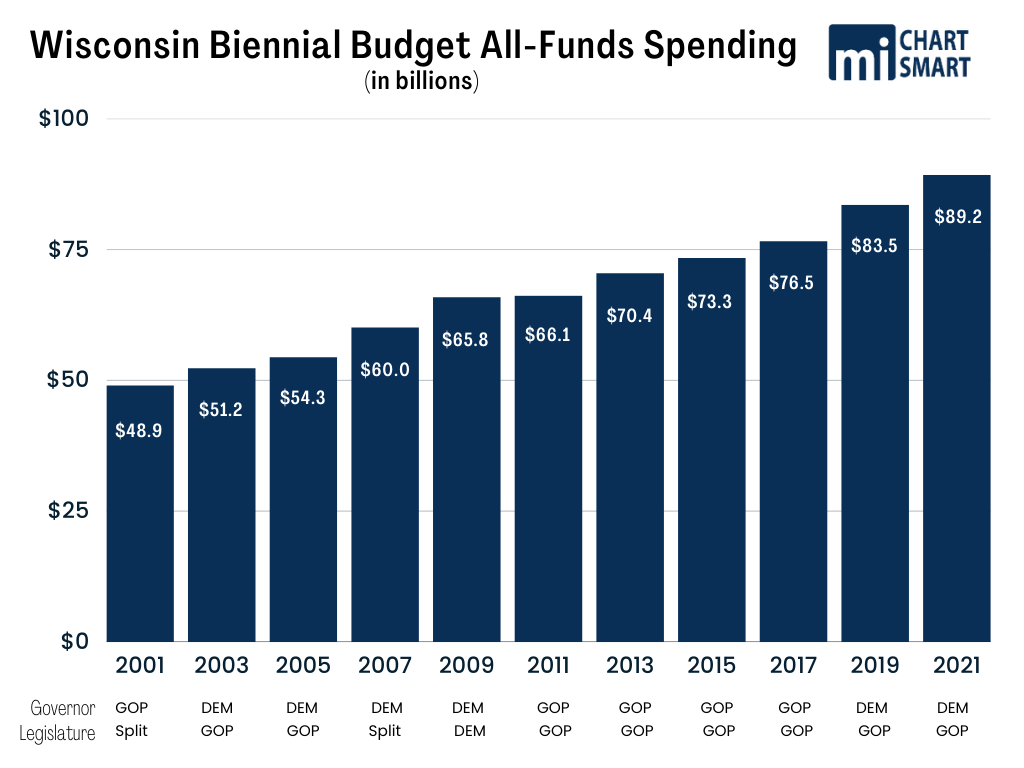

We’ve said it before, and we’ll say it again: Wisconsinites are overtaxed. Despite some progress with tax cuts, collections have outpaced – many times over – the income growth of taxpayers, and the legislature and governor have continued to increase spending apace.

A fair, flat tax – we advocate 3% – would level the playing field and cut the rate for every taxpayer.

Taxpayers are the best stewards of their money and as we face generationally high inflation, it’s time to keep more money in family budgets and out of the hands of the government.

But that tax relief cannot come wrapped in the sheep’s clothing of shifts, swaps and special treatment of one group over another.

- 3% Flat Tax

- The chart above says it all: we’re increasing the size of state government at nearly twice the rate of family income. Reducing the income tax across the board to a flat 3% would leave $4 billion in family budgets, and out of government’s clutches.

In the past, we’ve advocated a glide path, but generationally high inflation argues for more immediate action to let workers keep more of their money. The $6.6 billion budget surplus negates any argument that the state cannot afford to do it in the next budget.

- Cut Corporate Tax to Midwest Average

Wisconsin’s corporate tax rate of 7.9% is above the Midwest average. Cutting that rate to 6.5% – still more than double our proposed 3% flat tax – would encourage economic development. - Spending Limits

The rapid growth of state spending even under conservative leadership demonstrates a clear need for spending limits. Whether through a formula as local governments are limited, or tying any increases to a predetermined limit, action is needed to stop the spending sprees. - No Tax Swaps or Shifts

In recent years, tax shifts have been hyped as tax cuts, and some advocate for increasing the sales tax to make up for any income tax decreases. It’s clear Wisconsin has a spending problem; the solution is real tax cuts, not shifting the burden and calling it fiscal restraint.

Election Integrity

Trust in clean elections is foundational to democracy. But in the past years we’ve seen that trust eroded by problems big and small: inconsistency in administration, skirting election law, allowing outside groups to purchase access to local election activities, and state elections commissioners who lack commitment to the law or to voter trust.

Restoring the integrity of our elections, along with the trust that goes along with it, is one of the most important jobs facing the next legislature and governor.

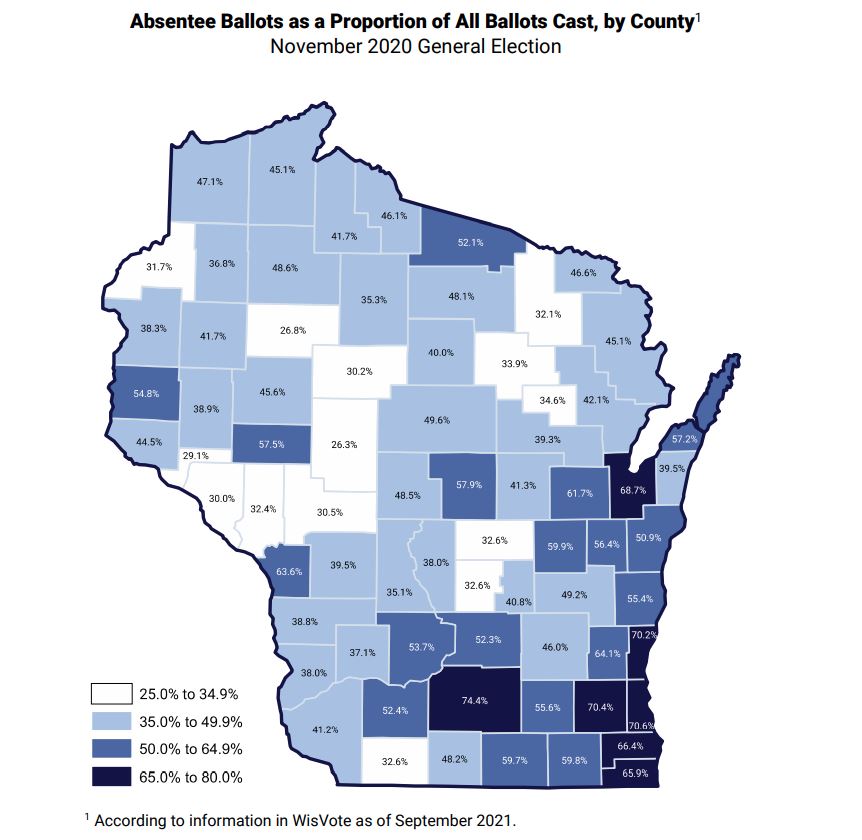

- Return to In-Person Voting

It’s clear we do not have the technology or the policies in place to adequately ensure accurate voter rolls, much less prevent fraudulent mishandling of ballots. It’s no coincidence that the counties with the highest absentee voting were targeted by the Zuckerbucks’ election-manipulators. We advocate a return to in-person voting on Election Day, with exceptions for military personnel and those with a documented medical reason. - Restore Voter Roll Integrity

Our voter rolls have been only haphazardly updated, blame resting both on clerks and WEC. We need specific statutory language mandating checking and correcting the lists repeatedly throughout the year to guarantee as much accuracy as possible. - Outlaw Ballot Harvesting

WEC issued illegal guidance telling clerks ballot harvesting was OK, though statutes do not allow it. A court ruling is currently preventing clerks from following the guidance, but statutory language banning ballot harvesting, and penalties for clerks who ignore the law, is needed. - Ban Election Outsourcing

Clerks are elected to run clean elections, not outsource the work to eager interest groups for cash. We need legislation banning private dollars and influence in election administration. - Fraud Investigations and Penalties

There is no consistent mechanism for potential fraud reporting, and no requirements for investigation or reporting on any investigations. We need both. And there should be stiffer penalties for voters, groups and election officials who break election laws. - Reform WEC

Leaders and staff in any election administration body must be committed to fair, clean elections, conducted with stringent adherence to the law. The many past iterations of WEC show it’s difficult to get right, but the legislature must make reforms.

Welfare Reform

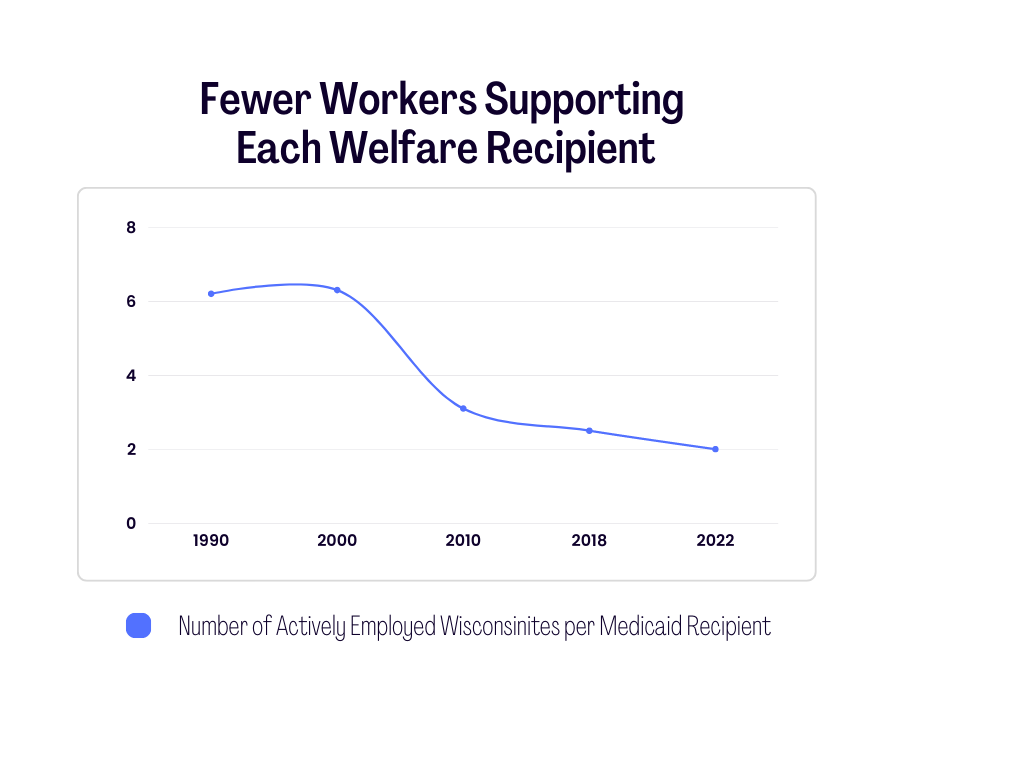

Welfare programs continue to grow. Our poverty rate is the lowest it’s been in over a decade, yet working taxpayers support more welfare recipients than at any time in that decade. A quarter of the state is on Medicaid, and there are fewer than 2 employed workers for every recipient. Generous as Wisconsinites are, we cannot sustain the growth of a welfare state that does not help – and yes, push – able-bodied recipients into the workforce to pay their fair share to help the truly needy.

We are at a tipping point. In an economy with 3% unemployment, we have about 300,000 able-bodied, working-age, childless adults on Medicaid, many of whom are no longer eligible, while the federal government is barring states from removing them even though low- and no-cost plans on the exchange are available for most of them.

- Work Requirements

Taxpayers should not foot the bill for able-bodied people who choose not to work. Work or training requirements should be part of every welfare program in the state. - Asset Tests For ABWADs

There is no asset test for able-bodied, working-age, childless adults. This means a person could quit their job, retain unlimited assets and still qualify for taxpayer-funded healthcare. Wisconsin should implement asset limits for this population. - Reject False “Fiscal Cliff” Argument

A “fiscal cliff” is the eligibility limit of the program and raising income levels is a costly expansion of the program. Transitional Medicaid and BadgerCare extensions provide short-term assistance for these situations. - Program Integrity

Known Medicaid fraud costs the federal government alone around $40 billion a year. Wisconsin’s share of that is in the hundreds of millions. Yet DHS hasn’t produced a fraud report in years. We need to re-engage on our efforts to both prevent and identify fraud to stop the theft of tax dollars. - FoodShare ID

Requiring the use of a program-specific ID card would help decrease fraud in Foodshare, which DHS warns is on the rise. - Eliminate Retroactive Eligibility

No health plan covers health expenses incurred months prior to enrollment, but Medicaid does. Wisconsin should stop paying old healthcare bills for people who chose not to enroll.

Accountable Government

It’s far too difficult for taxpayers to tell what the government they finance is doing, how their money is being spent, and how successful programs really are.

Walker’s Open Book was a huge step forward, but over time inconsistent entries, missing entries, and a clunky interface hinder its utility. Evers also abandoned the Walker Administration’s agency performance dashboards, which should be restored and expanded, but taxpayers deserve even more than that kind of basic level accountability.

Local government candidates should report finances online, in searchable format. Schools should post curriculum online. Government should not have the power to close houses of worship. Local governments should report into a Local Government Open Book.

After decades of budget increases that outstripped income growth and regular, large surpluses, it’s time for a budget that actually cuts spending, taxes and bonding.

- Reduce Spending

The next budget should spend, tax, and borrow less than the previous one. - Agency Performance Dashboards

Every agency, including DPI, should have a performance dashboard featured on their website displaying agency priorities, goals and progress, as well as programs that are falling short of success. DOA’s dashboard should cover programs with similar/duplicative goals within and across agencies. - Update Open Book

Open Book was a huge step forward in transparency, but it’s nearing a decade old, and it needs an update. The interface is clunky, and the lack of uniformity in entries can make it difficult to track spending. Plus, it’s not clear that agencies are entering all expenditures. - Open Book for Locals

Local governments should report uniform tax and expenditure data to an online, searchable database similar to the state’s Open Book. This will allow the public to compare municipalities, and identify both problems, and opportunities for savings. - Local Election Finance Reporting

Similarly, there is no reason the public should have to make and wait for open records requests of campaign finance information collected at the local level. And posting copies of forms – not searchable – online is little better.

Local candidates should be required to file their reports online, so they are searchable. - Fee Limits

To end-run levy limits, some municipalities have increased fees and fines to free up funds for their wish lists. There should be limits on fees as a proportion of the local budget, to prevent this tax shifting.

Healthcare Reform

Recent reports reveal Wisconsin has the 4th highest hospital prices in the nation and only 1 in 5 hospitals are complying with federal price transparency laws. Our health outcomes are declining as well – in part because widely-used measures have recently begun to include factors such as solo commuters, climate change policies, and segregation – but also because of gaps in access, workforce and accountability measures.

We have a quarter of our population on Medicaid, a shortage of health care providers that will only increase, an aging population more concentrated in rural areas with less access to care, and healthcare costs that continue to soar. And yet, policies that would help move the needle – even a little – on healthcare quality, availability and cost, have been left on the table. And there has been too little focus on our state’s looming Long Term Care needs costs, which will drive spending in the coming decades.

- Healthcare Quality and Price Transparency Dashboard

Wisconsin has gotten an F in price transparency for years, while our costs are 4th highest in the nation. Providers should be required to annually provide DHS the cash price for the 25 most common and 25 most expensive services they provide. DHS would publish the information, not regulate the costs. We should also mandate participation in an all-payer claims database that populates a robust quality and price transparency dashboard, to help patients make healthcare choices, and hold providers accountable. - Remove Scope of Practice Barriers

Shortages of healthcare providers at every level will continue to grow as our population ages and our workforce shrinks. More than a third of counties are already without an OBGYN. But instead of seeking solutions to expand access, providers are invested in turf wars. The result: higher prices for less access.

Eliminating barriers to full scope of practice is part of the solution to our access problems and our sky-high prices. The legislature should prioritize access to quality healthcare over protecting the current structure that deprives patients of access to affordable care. - Direct Primary Care

We have far fewer direct primary care providers per capita than average. This care model is a cost-effective method of allowing patients to pay cash to their primary care provider for access to a defined set of services. We need legislation to remove barriers and allow more patients to access the benefits of this model.