And Guess What? Neither Does Local Government!

Governor Evers is asking for another reckless and unsustainable increase in state spending. Here is why his request is unnecessary and unwise.

Larding unsustainable and unneeded new spending on top of recent massive spending increases

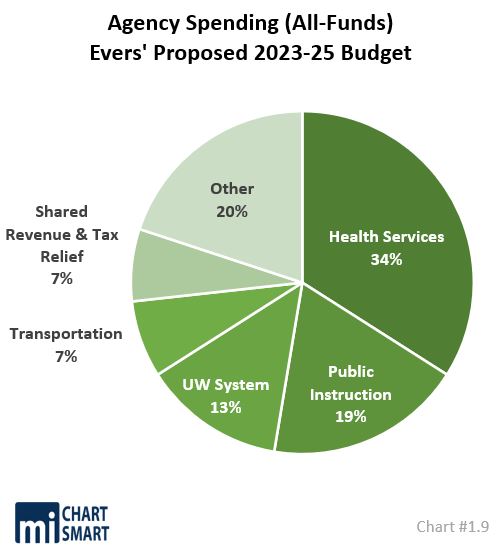

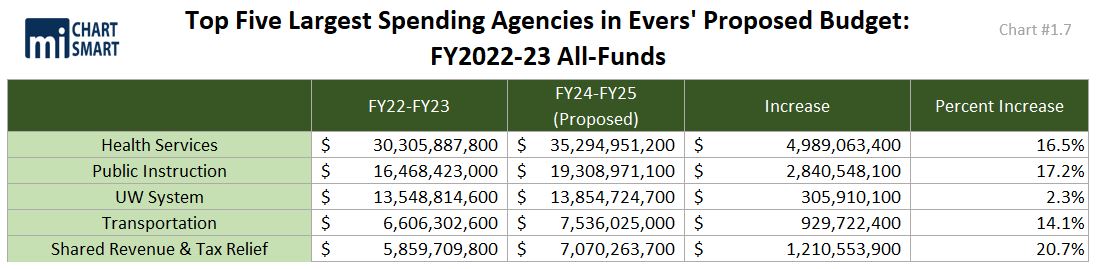

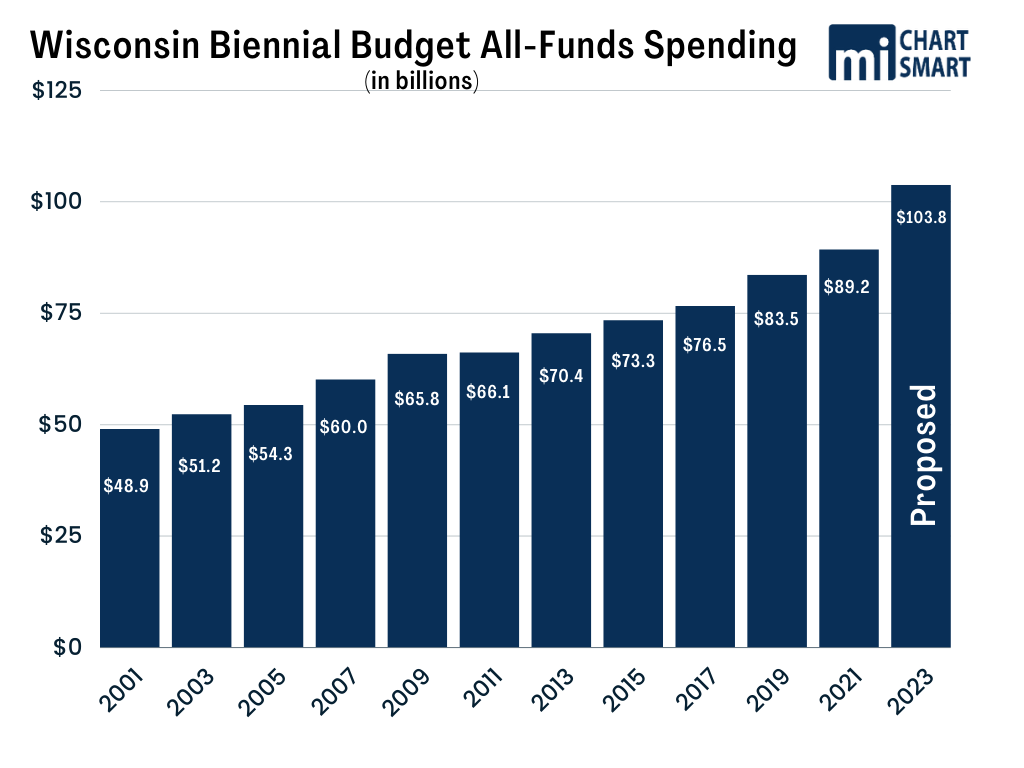

Governor Evers’ 2023-2025 budget proposal is the largest increase in our state government spending ever proposed. The 2023-2025 budget proposal spends $103.8 billion (all funds). If approved, this would be a roughly $15 billion increase over the 2021-2023 budget, or a 16.3% increase. This 2023-2025 $15 billion dollar spending increase would be on top of the $13 billion dollar spending increase contained in Gov. Evers’ first two budgets, the 2019-2021 budget and the 2021-2023 budget ($76 billion all funds base budget increased to $89 billion all funds spending in the 2021-2023 budget). If approved, this 3-budget, $28 billion dollar total spending increase ($76 billion to $104 billion) under Gov. Evers would be a staggering 35.7% increase over the base budget (2017-2019 budget).

For comparison purposes, spending increases under Governor Walker averaged about $3.1 billion every budget ($65.8 billion all funds 2009-2011 to $76.5 billion all funds 2017-2019). If his 2023-2025 budget is approved, spending increases under Gov. Evers would average about $9.1 billion every budget. Gov. Evers’ first two budgets (2019-2021 state budget and 2021-2023 state budget) increased on average about $6.35 billion dollars each.

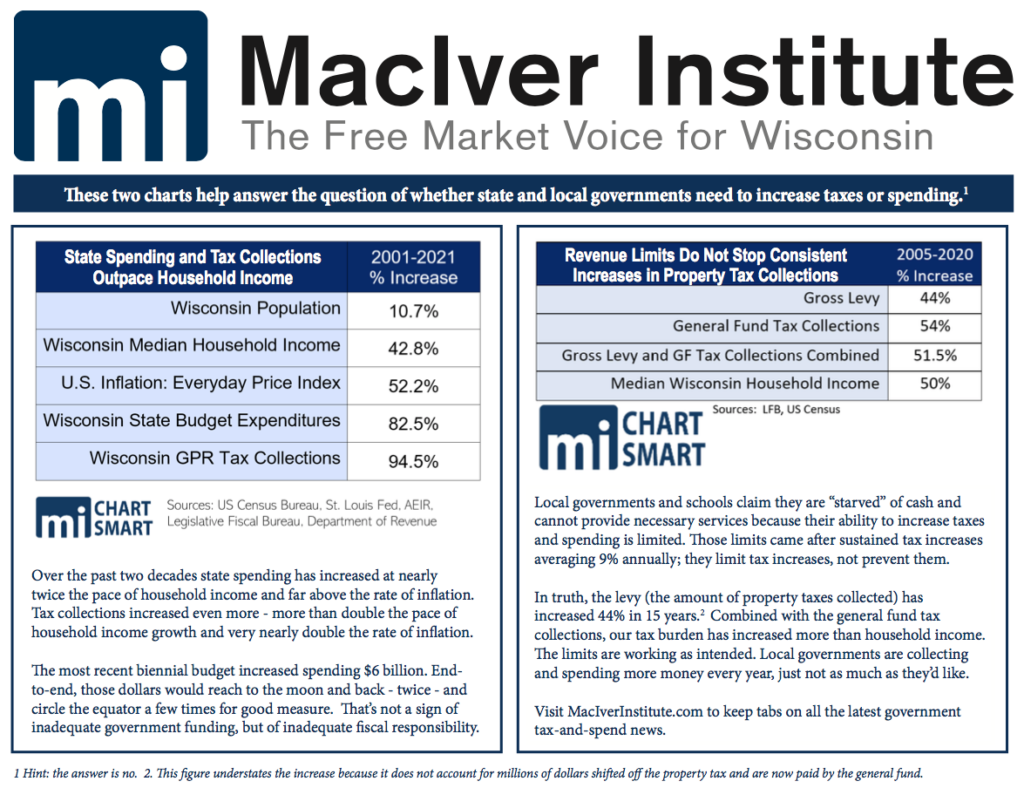

Thanks to the incessant, unrelenting push to always expand government, state government spending already outpaces the median family household income growth in Wisconsin. Again, state government is not destitute nor is it starving. Since 2001, our state’s population has increased 10.7% but our state budget spending has increased 82.5% and GPR (General Purpose Revenues) tax collections have increased 94.5%. Seriously, where in the ten commandments does it say that government spending must always increase, year after year?

The “surplus” $7 billion isn’t nearly enough spending

And forget about the $58 billion in covid aid…please

Gov. Evers’ spending increase is even more reckless when you consider that the state starts this budget process with a historic $7 billion dollar “surplus.” Spending the $7 billion “surplus” would have been right in line with Gov. Evers’ previous spending increases. We are going to keep pointing this out until we are blue in the face: the surplus is not really a surplus. The $7 billion surplus represents over-collection of your taxes. Wisconsin collected over $1,000 per person more than needed to run the already-bloated state government. Not only does that money belong to the taxpayers who are hard-hit by inflation, but for the government to use it as a slush fund to create even bigger state government means taxpayers generations from now will be on the hook.

Unfortunately, this gigantic spending increase was not enough for Gov. Evers. Instead, the Governor uses the entire $7 billion surplus for new spending and then dumps another $7+ billion on top of it.

Perhaps the best example of why the Governor’s budget proposal is unserious and a joke is the fact that, despite raising taxes by $1.5 billion to help finance this spending frenzy, his proposal doesn’t balance the accounting ledger. The Evers budget spends more than it takes in both years of the budget. This produces billion-dollar-plus structural deficits: $1.27 billion in FY 25, $1.41 billion in FY 26 and $1.46 billion in FY 27, which also has a negative projected opening balance.

If the Governor were serious about governing and not just obsessed with playing partisan political games, his gigantic spending frenzy proposal would at least be balanced.

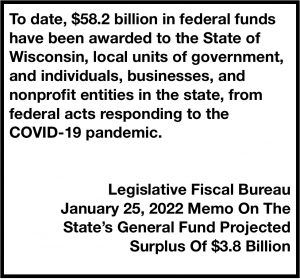

In addition to the $7 billion dollar surplus, another reason Evers’ spending increase is NOT needed is that the federal government has sent an unfathomable amount of taxpayer money to Wisconsin to fight covid and aid in the economic recovery. According to the nonpartisan Legislative Fiscal Bureau, $58 billion dollars has been sent to Wisconsin governments, businesses and individuals since the start of the pandemic. For context, the current state budget spends about $45 billion a year. The federal government has sent more than enough of your federal tax dollars to cover entire YEAR of state government spending. An entire year.

That $58 billion in federal aid means that state and local government did not have to spend $58 billion in local taxpayer funds to fight those problems, help individuals or to keep businesses open. That $58 billion in federal aid meant that state government and local governments could spend the tax dollars and other revenues they collect on existing programs and different challenges. Funny how this $58 billion in recent federal aid is never mentioned by the Governor or the mainstream media when the advocates for more local government spending cry poverty and try to convince taxpayers that the end of civilization is near unless you cough up more tax dollars. Maybe the reason local government advocates do not want to talk about or even recognize the $58 billion in covid aid is because of how many local governments have spent that covid aid on non-covid, non-critical items? In Wisconsin, covid aid has been spent on new artificial turf fields, skate parks, expanding an existing LGBTQ children’s library collection, and new Diversity, Equity and Inclusion employees – by the same elected officials who claim they can’t provide basic services.

All this federal funding cascading down on state and local governments, coupled with a quicker than expected economic recovery, means that no unit of government in Wisconsin – state government, your local school district, the city council or town board – is starving or in desperate need of more taxpayer money. All of this federal funding washing down on Wisconsin meant that even when Gov. Evers forced us into isolation and closed down the economy, government spending continued to increase like it always does and did NOT decrease like those who worship at the altar of Big Government tried to sell us.

Case in point: The Evers Administration was recently notified that the federal government is going to send Wisconsin an extra $186 million dollars in transportation aid (federal-aid highway funding, Joint Committee on Finance memo dated February, 13, 2023). Wisconsin was originally scheduled to receive $819,501,800 in aid from this specific program. Now, Wisconsin will receive $1,006,093,300, a 22.77% increase.

Do you think the state Department of Transportation decreased its budget request to the Legislature by 22.77% to account for this “extra” federal funding and give state taxpayers a small break? Of course not. Instead, the Evers Administration wants to lard this extra federal transportation aid on top of the already-generous state transportation aid just like it tried to do with K12 funding in the last budget. It should be noted that of the “extra” $819,501,800 federal transportation aid, the Evers Administration would like to spend $46,579,500 of it on climate change projects. That $46.6 million is not going to fix our “damn” roads like Governor Evers would say or rebuild our bridges. That is $46.6 million not going to what is best for our transportation system. That is $46.6 million going to be wasted on a non-serious climate change agenda to reward his political base.

Local governments in Wisconsin are starving, we swear

One of the main reasons Gov. Evers is using to justify his reckless spending request is that local units of government in Wisconsin, ‘local partners’ as he likes to call them, are teetering on the verge of bankruptcy and in desperate need of more taxpayer funding. If you believed the leaders of local government, you would swear that our jails were crumbling to the ground right in front of our eyes and that our children were wandering the streets aimlessly barefoot and unwashed.

Big Government advocates and many in the mainstream media are trying to convince the public that local units of government are destitute and on the verge of collapse. This is simply not true. First, property tax protections are built in such a way that local government is allowed to increase spending every year. The total amount of property tax collections at the local level (the levy) has increased 44% in 15 years. While this spending increase may not be as large as Big Government advocates want, it is still a spending increase. No city, school board, town or village has had to cut its level of overall spending. They always see an increase in their spending. Their current budget always spends more than the last, not less. Always.

So, instead of talking about a real spending cut, local government here in Wisconsin is talking about wanting a larger spending increase than what they normally get. That is a much different conversation and debate than the hair-on-fire, western civilization is going to collapse unless state taxpayers give us a tidal wave of new tax dollars hysteria they are pushing. Much different.

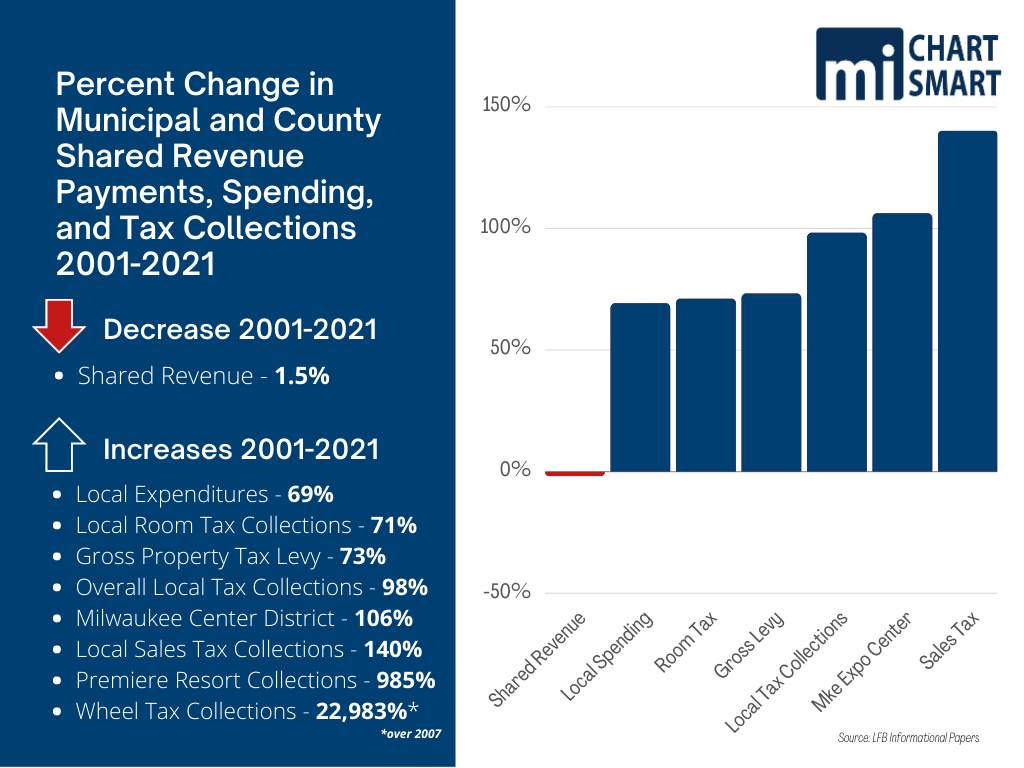

“But, inflation has been killing local government ever since Biden became President!” Okay, so a Mayor is never going to blame the person actually responsible for inflation, President Biden, but you hear this complaint all the time from local governments in this debate. Remember, the overall 98% increase in local tax collections from 2001 to 2021 in the chart above (Graphic 4) compares with just a 52.2% in inflation over the same time period (Graphic 2).

Sure, inflation has increased dramatically in recent months but let’s not forget that government is one who caused the inflation in the first place. To now use the inflation they caused as the reason to take more from taxpayers is ironic and cruel. The real concern should be how taxpayers are dealing with inflation and how taxpayers are able to pay their significantly higher living expenses, not how the poor government bureaucrats with their cushy jobs and platinum benefits are getting by.

Remember when the increase in inflation was small and minimal under President Trump? We don’t remember government telling taxpayers that we will give you break this year on your taxes because inflation is low. Funny how inflation is only mentioned when it is used to justify more government spending and higher taxes.

Our precious shared revenue has been frozen

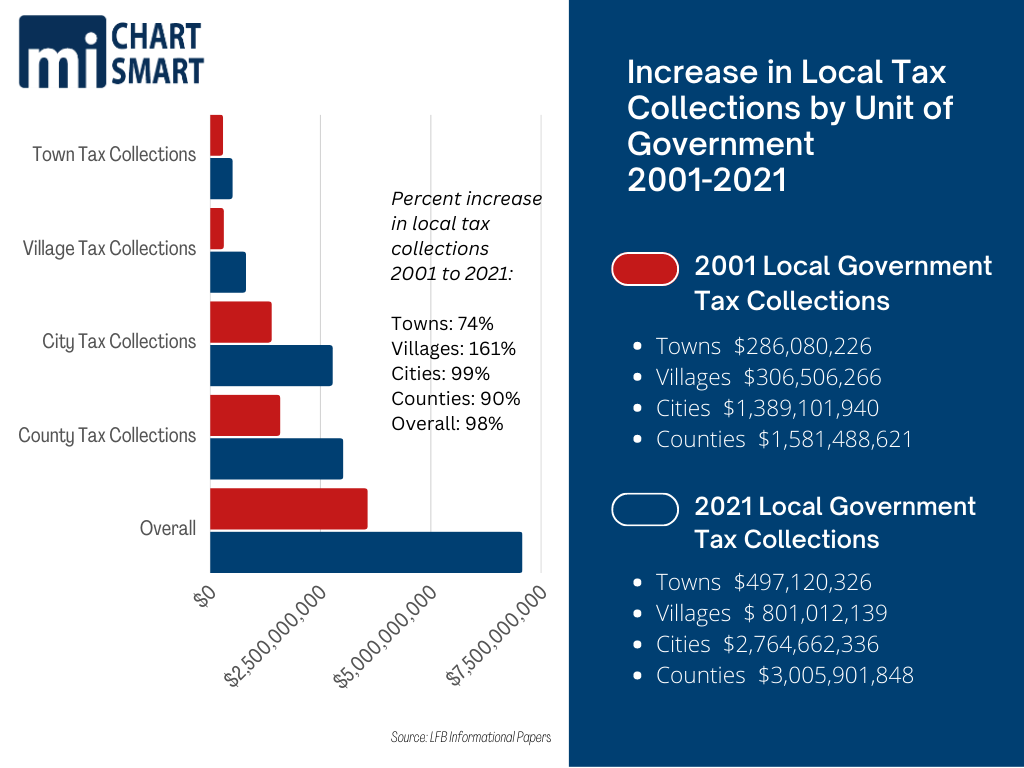

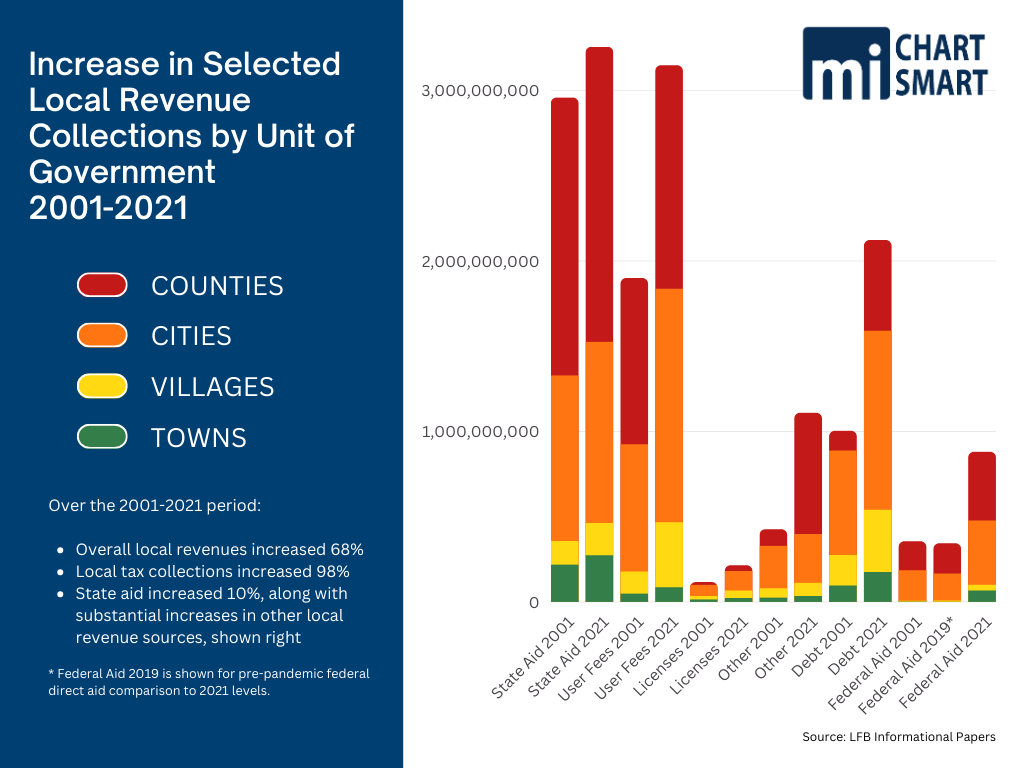

While local governments claim the frozen shared revenue funding they receive from the state has driven them to poverty, this chart (Graphic 5) provides perspective. It shows the increase in local government tax collections, by unit, from all tax sources, property, sales, room, wheel, premiere resort, etc. from 2001 (red) to 2021 (blue).

In 20 years, the amount of taxes collected by local governments has very nearly doubled, increasing 98%. During this same time period, median household income increased just 54%, roughly half the rate of local government taxation.

Shared Revenue collections have declined 1.5% during the period, though it’s important to note that these payments to local governments is one of the top 10 state expenditures along with K12 Education, and Medicaid. The state sends $2.5 million every day to locals through shared revenue. Meanwhile local spending has increased 69%, the property tax levy has increased 73% and local sales tax collections soared 140%. Wheel tax collections – now levied by many units of government – has gone up 23,000% just since 2007.

So clearly, shared revenue is not central to a local government’s spending. And then on top of that, local governments have a multitude of local taxes that feed their spending increases other than shared revenue. Start with their main and biggest tax revenue source, the property tax. The property tax levy has increased 73% from 2001 – 2021. That is a 3.65% increase every year (73 divided by 20). Each 3.65% increase is built on top of the previous 3.65% increase, always increasing each and every year. Never a decrease. Somehow, we are to believe that local government has experienced a cut in their spending and it is wasting away on the vine.

In addition, some local governments benefit from special taxing authority. Several jurisdictions levy a “premiere resort” tax, and since 2001 those collections are up nearly 1000%.The City of Milwaukee created a Wisconsin Center Tax District, which levies additional taxes in all of Milwaukee County on food, beverage, lodging, and car rentals. Those collections have more than doubled, currently providing a nearly $30 million revenue stream for Milwaukee only. Of note, the Center District collections were substantially higher in 2019, and have fallen below 2017 levels. Some of the decline may be attributed to the pandemic. But Milwaukee’s highly publicized spike in violent crime and carjacking and substantial decrease in the police force are likely stronger factors, as the city is increasingly perceived to be unsafe.

The city of Milwaukee just announced that it is increasing the number of hours parking meters are in effect downtown and applying the parking charge to Saturdays as well. According to one news source, these changes could bring in an additional “million dollars a year annually” to the city. Don’t worry, Milwaukee will surely knock off a million dollars from its shared revenue request to the Legislature in the name of fairness and honest budgeting.

Unfortunately, it is never mentioned in this shared revenue debate but it should not be forgotten, state government has taken on the financial responsibility for some local spending paid for by the property tax. For example, in recent years, the state has instituted the following tax shifts which have reduced the property tax levy:

- Shifted about half the funding for the Technical College System from the local property tax to state tax dollars, reducing the local levy and thus the overall levy by hundreds of millions of dollars.

- “Eliminated” the personal property tax, by shifting it off the property tax levy and paid for by state tax dollars.

- “Eliminated” the forestry mill tax from the levy by shifting it to the general fund and paid for by state tax dollars.

Shared Revenue and property taxes are by no means the only sources of revenue for local governments. The chart above (Graphic 6) shows some of the other local government revenue sources and the increases between 2001 and 2021. State aid, which has risen, is separated from direct federal aid to provide a more clear picture of the intergovernmental revenue received by local units.

Local governments insist revenue limits and the freeze in shared revenue have left them impoverished and unable to provide services. In point of fact, both revenues and expenditures at the local government continue to increase, well above the median income of the taxpayers that fund them. Wisconsin’s median household income has increased slightly above the rate of inflation, but both state and local governments have blown past the rate of inflation in their collections and spending. If the spending at the local level has never been cut, and in fact, has increased dramatically, that undermines their argument that the freezing of shared revenue has caused them great harm or hardship.

What did you spend your Act 10 savings on?

Also part of this conversation must be the $17 billion dollars in taxpayer savings achieved through Act 10. While your school board and city council publicly complained about how horrible Act 10 was, to curry favor with government employees, these local units of government gladly grabbed the savings Act 10 provided and spent that savings at the local level. To date, local government savings from Act 10 has reached over $12 billion dollars.

That $12 billion dollars in savings stayed with the local unit of government, it was NOT sent back to state government or automatically returned to you, the taxpayer. In general, local government got to spend that $12 billion in savings as they saw fit. Guess what? Most local governments spent that savings on other programs or needs. The first question that must be asked of any local government looking for more taxing authority or more tax dollars is, what did you spend the Act 10 savings on? Second question should be, if you are so desperate for more taxpayer dollars to spend, why don’t you use Act 10 again to require your taxpayer-financed employees to pay for their health insurance and retirement the average, just the average, cost of those benefits for a private sector worker? According to the Kaiser Family Foundation, a worker contributes on average 17% of the premium for single coverage and 28% of the premium for family coverage. Wisconsin state law only requires government employees contribute 12% toward their health care coverage.

Again, considering the complete fiscal picture and adding this important context changes the public policy discussion dramatically. Any way you look at this puzzle, state and local government in Wisconsin is not dirt-poor or penniless.

Property tax limits were instituted for a reason. Before they were instituted, it was common for local units of government to jack up your property tax bill 8% every year. Every year. The public outcry was loud and from every corner of the state. Wisconsinites demanded that the Governor and the State Legislature do something because local government could not be trusted to be prudent or even reasonable. Governor Evers’ constant and repeated attempts to weaken the property tax limits is another reason why local government in Wisconsin is not starving or destitute.

There is a reason why property tax limits were put into place

Last but not least, local spending limits were put in place for a reason, a very good reason. They were necessary and popular with voters. Property taxes skyrocketed in the late 70s through the early 90s. Governor Tommy Thompson, the state’s most popular governor ever, recognized the taxpayer fury that was erupting all over the state. Quite frankly, it was not really so much Tommy saw something no one else could see, it was the widespread outcry from homeowners asking the Governor to do something about local tax increases and spending made it impossible to ignore. No wonder. The annualized average property tax levy increase was more than 8% between 1975 and 1991. Think about that for a second. An eight percent increase a year, every year.

Governor Thompson stepped in. The state agreed to take on ⅔ funding of schools while restricting local levy (limiting the amount property tax collections could go up) increases. The goal was to stabilize property taxes and stop unfettered local spending from taxing people out of their homes. It worked, it was immensely popular, and Gov. Thompson easily cruised to re-election repeatedly.

While politicians of all stripes today would do well to remember these lessons, conservatives in particular should recognize why limiting the spending of local governments is good public policy and good politics.

Conclusion: Wisconsin state and local government have been on a fevered spending spree for years – time to stop the madness and put taxpayers first

Any way you look at state and local spending, any way you dissect this question, any way you truthfully analyze if government in Wisconsin is impoverished and deserving of massive influx of your tax dollars, the answer is no if you are a taxpayer. Or purport to care about the taxpayer. If you worship at the altar of Big Government, the answer is yes, the answer is always yes.

Don’t let the special interests lie by talking about select “facts” or only half of the picture, don’t believe the mainstream media when they automatically parrot the talking points of Governor Evers or your Mayor, and don’t ever stop asking asking pointed questions of your public servants or demanding real answers from those who want to spend more of your money.

Let’s make this the taxpayers’ budget.