Task Force considers high speed rail, eminent domain for bike path construction, increased gas tax, road use tax, and an economy-killing energy production tax

Lt. Gov. Barnes says if the Legislature won’t pass recommendations, state agencies will

September 16, 2020

By Lexi Dittrich

A few things are becoming clear while observing the Governor’s Task Force on Climate Change: members have a lot of big ideas and want big changes to our way of life that require big bucks to fund those changes.

The Task Force has been working to produce a list of recommendations since late 2019. The Task Force has a deadline of October 31 to deliver a list of 30 recommendations to Governor Tony Evers. Gov. Evers asked the group to come up with recommendations on how the state of Wisconsin can become completely carbon-free by 2050. No coal, no natural gas, only “green” renewable electricity sources.

Another thing has become clear throughout the Task Force’s meetings: if an idea is too controversial to be included in the final report, there are other avenues to force that idea onto Wisconsinites.

On August 10, at the Healthy Communities and Strong Economy subcommittee meeting, Lieutenant Governor Mandela Barnes said that any recommendations that don’t make it to the Governor’s desk, or don’t have legislative support, will be put into a “parking lot” of ideas.

These parking lot ideas will be used to create legislation, turned into executive orders, or added to the 2021-2023 state budget. Barnes went on to say that some of the recommendations that are too controversial for the final report could also “still be applied without having to be put in the budget or be put into legislation. Some of our agencies can more easily implement these as rules.”

“Just because things don’t make it into the Task Force recommendation list doesn’t mean that they aren’t valid and may not have an area to be explored somewhere else,” Barnes said on August 26. “The parking lot will serve as a place for ideas like these to all be able to continue to live.”

“If things can happen without the legislature, let’s note-take them and we’ll put them in the parking lot,” Barnes said. When the Task Force “note-takes” an idea, they’re literally earmarking a proposal that can be forced onto Wisconsinites without having to go through the Legislature. Lt. Governor Barnes is advocating that the Evers Administration implement some of these radical and costly ideas through unelected agency bureaucrats, rather than going through the normal and deliberative legislative lawmaking process. That should concern anyone who believes in Democracy and the rule of law.

Before Lt. Gov. Barnes and the Task Force formally forward their recommendations to Governor Evers, we think Wisconsin taxpayers deserve to know what sort of changes the group is advocating for and, more importantly, how these changes will affect life in Wisconsin and your bottom line.

Note: We analyze some ideas below that are from earlier Task Force documents, but have not made it into the Task Force’s most recent recommendations draft. Since Lt. Governor Barnes believes many of these ideas, even if they are too radical or controversial for the final report, could potentially be implemented through other means, we think it is necessary to highlight and discuss the merits of these proposals.

Higher Taxes To Pay For It All

As you can imagine, many ideas from the Task Force come with a large price tag. State government will need to pay for these projects with money from you, the taxpayer.

The most discussed tax on the table is a carbon fee and dividend, better known as a carbon tax. The idea is to tax carbon emissions at the source, like taxing oil fields, coal mines, and carbon fuel importers. Those taxes would get collected by the state and then sent back to some taxpayers in a socialist-type redistribution scheme.

Jonathan A. Lesser from The Manhattan Institute writes that a carbon tax at the source wouldn’t exclusively affect the source of carbon-based energy. It would inevitably reach all levels of our economy “because energy is used to produce virtually all goods and services.”

Fuel is used in factories to create products. Fuel is used by vehicles that transport the products. Fuel is used to keep lights, air conditioning and the heat on in the businesses that sell the products. A tax on the fuel that is necessary for all of those operations will lead to inflated costs for everything we do to keep the economy functioning.

As Grover Norquist of Americans for Tax Reform notes, “a carbon tax raises the cost of heating your home in the winter and cooling your home in the summer. It raises the cost of filling your car. A carbon tax increases the cost of everything Americans buy and lowers Americans’ effective take home pay.”

Given that our economy has been largely shut down in response to COVID-19 and hundreds of thousands of Wisconsinites have lost their jobs, a new tax on economic productivity, or any new tax for that matter, will kill off many small businesses struggling to survive in this pandemic and hit families especially hard that are scrambling to make ends meet.

Wisconsin knows a lot about another tax that the Task Force considered increasing, the gas tax. Wisconsin already has a relatively high gas tax at 32.9 cents per gallon. Gov. Evers tried to raise the gas tax by 10 cents in his last budget, which would have taken about $485 million more from taxpayers over the biennium. That proposal was rejected by the Legislature. While the Task Force has strategically decided to not specify how much the gas tax should be increased by, we know that the new spending the Task Force is advocating for is not small. Billions more in new spending could very easily require a 25 cent to 30 cent increase to the state’s gas tax.

The Task Force also proposed an unquantified “road use tax” that would be “great enough to incent the use of train.” How high would the tax have to be to force people out of their cars and onto the train? Would a $1.00 increase per gallon on the gas tax “convince” you to stop driving? Two dollars?

.@WisconsinDOT Task Force will consider "dizzying" number of tax and fee hike options on Monday. Some, like the @LeagueWIMunis couldn't wait to pitch their own ideas on where to raise taxes next. #WIright #justfixit pic.twitter.com/NutmSF0j5o

— MacIver News Service (@NewsMacIver) February 1, 2019

Or would a road use tax look like a mileage-driven tax? Gov. Evers’ 2019 Transportation Stakeholder Taskforce proposed a mileage-based registration fee. That proposal had the government tracking the number of miles you drive and charging you 1.02 cents per mile if you drive a passenger vehicle or light truck. Allowing Big Brother Government to spy on you and track your driving habits would raise taxes by $228 million every year. A road use tax or a mileage-based registration fee are always cast by proponents as a usage fee and it is only fair that those that use the roads the most should pay for that service. The problem is that the proponents never acknowledge that we already have a road usage fee in place, the gas tax.

Not to mention that a road use tax would hit those of us who have to drive long-distances for work or those of us who live in rural Wisconsin the hardest.

Higher Taxes To Fund More Mass Transit And High Speed Rail

Speaking of road taxes, the Task Force has plenty of transportation ideas that taxpayers will need to pay more for.

The Task Force is proposing an extra $50 million per year toward general public transit funding “to help meet current and future needs.” Those “current and future needs” seem to have been taken right out of the Green New Deal. Think high speed rail, green buses and trains, free public transportation, construction on new electric vehicle infrastructure, and incentives to promote public transit. Comments from the public have also suggested using funds to double public transit use by 2030. The “future needs” list of projects is long and expensive so it is likely these will cost much more than just $50 million more per year.

For comparison, Gov. Evers wanted to increase state aid to mass transit by $13,842,400 over the 2019-21 biennium, a 10% increase over two years. The Task Force is asking for nearly four times the increase the Governor was seeking and the Task Force is seeking that dramatic increase in just one year. The Wisconsin State Budget spends approximately $113 million on mass transit aid every year.

The Task Force is pushing another policy called “complete streets,” a state mandate that would require all future state-funded road projects to include bike and walking paths. Yes, that includes paths built on a new highway. A 2017 investigation by MacIver revealed that adding bike and pedestrian paths costs $200,000 extra per mile constructed, on top of the regular price of a road construction project.

Also on the Task Force’s wish list is restoring eminent domain authority so the state can confiscate private land for walking and biking paths. Private property rights are central to the American Dream and crucial to our liberty and freedom. Any change that allows the government to diminish or restrict our liberty should be met with skepticism and concern.

State Government Control Of The Economy And Industry In The Name of Equity

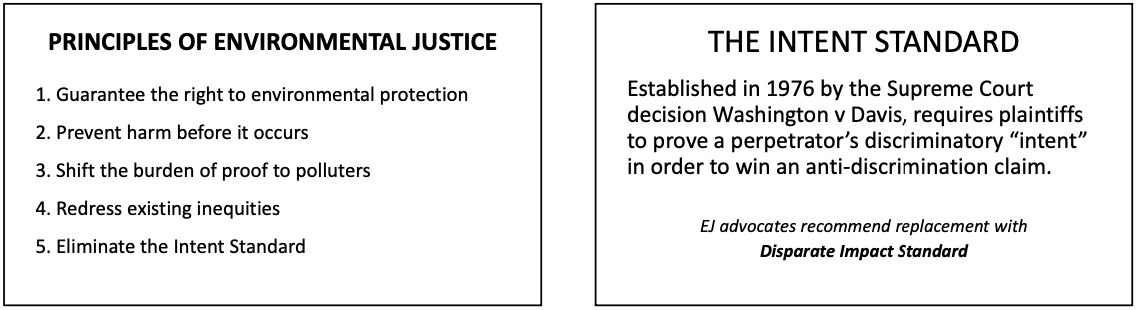

Businesses beware, the Task Force is also proposing a new bureaucrat-run office that could take you to court for perceived environmental injustice, even though you are already a heavily regulated and law-abiding business.

The Task Force is proposing the creation of the Office of Environmental Justice and Equity. The office would hire 3 new full-time bureaucrats who would seek out low-income, minority, and other disadvantaged Wisconsinites who “may be experiencing more harm or are more susceptible to environmental conditions.” The state would respond to these environmental conditions by producing environmental justice analyses and suing businesses to achieve environmental justice.

The Office of Environmental Justice and Equity will likely take a page out of Task Force member August Ball’s book. Ball gave a presentation late last year to the Task Force where she said that businesses accused of injustices and “environmental racism” need to be brought to court and forced to prove their innocence. Think about that for a second. Businesses would be considered and presumed guilty, not innocent. Innocent until proven guilty has been a hallmark of our country since our founding and a bedrock of our judicial and legal system. Now, in the pursuit of social justice through climate change, that apparently no longer matters. We need to think about what a truly drastic change this would be and how scary it would be to live in a world that is based on guilt, not innocence.

Shutting Down Reliable Coal Plants And Restricting Your Energy Use

Remember, the Task Force was created to make recommendations to Gov. Evers on how to push Wisconsin to be carbon-free by 2050. According to the Wisconsin Public Service Commission (PSC), as of 2018, 10.34 percent of Wisconsin’s electricity sales came from renewable sources. It’s unclear if Wisconsin is capable of going from 10 percent renewable energy to 100 percent in just 30 years. Even if it is possible, it will be expensive and mean higher electricity bills for ratepayers and businesses.

The Task Force discussed recommendations on how Wisconsin might achieve 100 percent carbon-free electricity by 2050. One recommendation would require a profound and expensive shut-down all coal plants by 2050. Task Force members from the different utility companies in the state have pointed out a hard truth: retiring a plant early requires taxpayers or ratepayers to pay the utility for their stranded assets or costs.

If an energy company is forced to shut down a coal plant by 2050, but the debts on the plant haven’t been paid off yet, the company still has to pay back the debts. Only now, they cannot generate the profits from the coal plant needed to pay the debt. To make up for these stranded costs, the utility would seek approval from the PSC to raise their electricity rates. The money required to retire a coal plant early would NOT come from the company’s budget or the shareholders of the utility stock. The money would come from higher electricity bills, paid by homeowners and businesses. Raising the cost of electricity is the last thing ratepayers and the working poor need as the economy continues to recover from Wisconsin’s COVID-19 shutdowns.

Another way the Task Force plans to achieve their carbon-free energy goal by 2050 is through a set of draconian, socialist “energy use reduction goals.” Energy use reduction goals would require that Wisconsinites and businesses use less electricity, natural gas, propane, heating oil, and gasoline. While the Task Force, once again, did not lay out specific details on how this central planning would work, it is safe to assume that if you or your business went over your government-approved electricity amount for the month, you would have your electricity turned off or you would be forced to pay an exorbitant over-usage tax to keep your air conditioner or your assembly line running.

A Government Program To Create Free Market Green Jobs

Barnes and company believe that Wisconsin needs to be forced to transition to a green economy, even though the green economy cannot stand on its own legs now and many Wisconsinites currently working in the energy sector would lose their jobs in this transition. The Task Force is proposing to make up for the job losses through a Green New Deal-inspired “Job Transition Act.”

This government-mandated push to a green dream economy would eliminate $1.16 billion of wages and productivity from the Wisconsin economy.

The Soviet-style centrally planning program would have taxpayers pay to have workers from traditional energy industries transition to green energy occupations. This program will be expensive for taxpayers because it proposes “full unemployment pensions, health care, and insurance based upon their previous salary for up to three years” as the individual transitions to a green job.

This government-mandated push to a green dream economy would destroy good paying, family-supporting jobs. According to the 2020 US Energy and Employment Report, Wisconsin employed 13,450 people in non-renewable energy and fuel sectors in 2019. At a national mean wage of $85,900 for all traditional energy sector jobs, the Task Force would eliminate $1.16 billion of wages and productivity from the Wisconsin economy.

The Jobs Transition Act claims to make up for the jobs lost by promising “millions of well-paying, union jobs” in fields like “sustainable agriculture, engineering, manufacturing, construction, energy efficiency retrofitting, coding and server farms, and renewable power plants.” Sounds too good to be true, doesn’t it? Not only is the Task Force promising tons of clean energy jobs–courtesy of the taxpayer dollar–that presently do not exist but it is also assuming that the government knows better what our economy should look like than real-life customers. What could go wrong with that approach?

Climate Re-Education For The Public And Climate Indoctrination Curriculum For The Kids

For those of you who aren’t sold on the high cost of the proposals above, the Task Force thinks they can change your mind by paying for a “robust campaign to create public demand for urgent action to reduce carbon emissions and a willingness to personally pay more for products and taxes that reduce carbon emissions.” Creating “public demand for urgent action” means state government will push a fear and panic campaign to scare Wisconsinites. If the public doesn’t agree with our policy proposals, no worries, we will take to the airwaves to “convince” them what they should believe.

Don’t think the kids are left out of the Task Force’s plans either. The Task Force is also recommending mandatory Climate Science and Climate Justice in K-12 Curriculum in all public and private K-12 schools. That’s your tax dollars used to teach your kids to tout an environmental and equity political agenda, some would say a radical agenda, starting at the kindergarten level.

Wisconsin has already witnessed a preview of what the Task Force’s climate justice curriculum could look like. Last December, teachers from Milwaukee Public Schools pulled high schoolers and elementary schoolers out of class to protest against Wells Fargo and Chase Bank’s donations to fossil fuel companies. Schools in Madison, Milwaukee, Baraboo, Appleton, Ashland, and LaCrosse also let kids march out of classes last September for a statewide strike against climate change, lead by the radical Marxist Youth Climate Action Team (YCAT). A statewide climate change curriculum would certainly mean more of these types of marches and protests held during the school day and less time spent on critical learning.

Is It Too Late?

Even though we have highlighted just a few of the proposals under consideration, the price tag to implement these new policies is astronomical. In fact, one Task Force member expressed concern about the “daunting” price of all the proposed programs, claiming that the Task Force was ringing up “trillions” worth of new spending at the state and federal level.

The Task Force believes they’ll convince you to go along with the high price of all their plans before they tell you how much it will cost you in higher and new taxes. To Barnes and other members of the Task Force, it doesn’t matter how high the price is or that we currently are in an economic downturn. They believe the short-term pain you will feel is worth the long-term goal of a green economy. After all, Barnes believes that America needs to “stymie” the growth of capitalism in order to end climate change, so it makes sense that he wouldn’t care about the harm his plans would do to the economy.

The question is, will the average Wisconsinite, who is worried about losing his or her job during COVID-19, or the business owner, trying desperately to keep their doors open during the shutdown, notice how radical and expensive these Task Force recommendations are? Will they take the time to let their politicians know how they feel?

And if the hard-working taxpayers of Wisconsin do make their voices heard, will the Evers Administration take heed or will Lt. Gov. Barnes push his bureaucrat-imposed green nightmare on the state?