Average tax increase would be $9,300

Pass-through small businesses would be hit

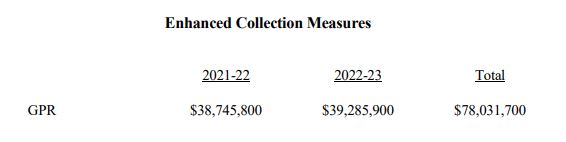

“Enhanced Tax Collections” would raise $78 million using 8 now permanent auditors

March 29, 2021 | MacIver News Service

Budgets are about priorities, and Gov. Tony Evers’ budget proposal puts small businesses and the middle class pretty low on the list.

Overall, Gov. Evers’ budget would increase taxes by a billion dollars over the next two years. He would decrease taxes by $536.2 million in other areas. Fees would go up $17.16 million. Evers also believes he can squeeze another $78.03 million through “enhanced tax collections.” Gov. Evers would also make permanent 8 auditor positions at the Department of Revenue to help with those collections.

How everything pans out across the state budget varies wildly and sometimes without reason. Everyone would be paying more somewhere in their life. In some extreme situations, the poorest of the poor could actually see a state income tax hike that sucks up more than 25% of their total income, according the Legislative Fiscal Bureau.

Tax Hikes

Although the federal Tax Cuts and Jobs Act of 2017, in general, lowered taxes on business, there were tradeoffs. Gov. Evers wants to cherry pick the provisions that increased taxes and implement them in Wisconsin. These includes limited deductions for: losses for all businesses but corporations, research and development, employee expense accounts, and FDIC insurance premiums among others. This will bring in an extra $540.1 million over the next two years.

Another provision specifically targeting operating losses for individual income taxes would hit small businesses up for $4.1 million over the biennium.

Manufacturers would take another big hit on top of that. Evers’ budget would limit claims for the Manufacturing and Agriculture Tax Credit to $22,500 for “income derived from manufacturing activities,” according to the Legislative Fiscal Bureau. That would increase the state’s take by another $457.4 million on the backs of businesses.

Evers’ budget would also go after capital gains, which means it goes after retirees. By limiting this exemption, the state would take another $350.5 million over the biennium.

“Sin taxes” would go up. The state would take $29.3 million from vapers and $5.3 million from “little cigars.” If the state were to legalize marijuana, it would bring in $165.8 million a year.

Tax Cuts

This billion dollars in new taxes would be offset by a half-billion in tax cuts to Evers’ preferred interests. Many of these items would have a minimal or unknown impact on the state’s balance sheet.

“Family caregivers” would get most of the new tax relief in Evers’ budget. They would receive a $500 individual income tax credit. This exemption will have a $100 million impact annually, which means as many as 205,000 people would be eligible for it. According to the CDC, 20% of adults in Wisconsin over the age of 45 are caregivers.

Another $52 million would go to the Work Opportunity Tax Credit. The credit would be up to 20% of an employee’s first year of wages if they fall within one of the targeted demographic groups.

Expanding the Earned Income and Homestead tax credits account for another large portion of his tax cuts. Evers would spend $148.3 million more on the earned income tax credit – those are tax refunds to people who don’t pay taxes. Another $68.9 million would be for the homestead tax credit.

Fee Increases

There are 24 individual fee increases in Gov. Evers’ budget proposal, totaling $17 million. These include an extra $55 for lobbyist, $20 for notary publics ($50 if you’re a lawyer), and $100 for pharmacy benefits manages.

“For taxpayers with a tax increase, the average increase is estimated at $9,300,” according to the Legislative Fiscal Bureau

If you want to dig a new well it would cost you another $20. If you go duck hunting, count on paying another $5 for each bird.

Large farms would get hit with a $200 increase in Concentrated Animal Feeding Operation Fees. New operations would have to pay $3,270 up front.

Public libraries would get an extra $6.5 million in Evers’ budget, which would come directly from new fees on your cell phone, cable, and internet bills.

Income Tax Impact

The Legislative Fiscal Bureau ran a simulation to determine how all these changes would impact individual income tax bills, which include many small business filers.

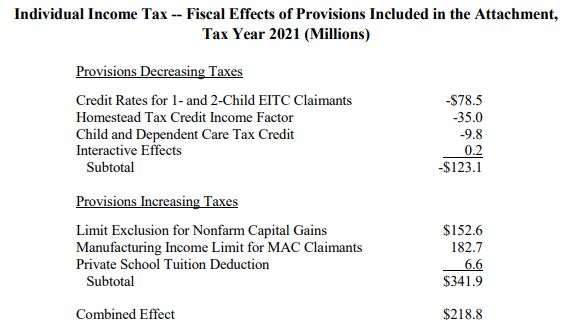

Of the one billion dollars in tax hikes, $341.9 million would come directly from income taxes. Of the $536.2 million in tax cuts, $123 million would go to income tax cuts.

LFB estimates 519,210 filers would get a tax cut, and 36,760 would see a tax hike. The average tax increase for those 36,760 filers would be $9,300. The average tax cut for the 519,210 filers would be $237. Filers in all income groups would be impacted by both the cuts and hikes.

According to the simulation, there would be 890 files who make less than $5,000 a year, who would get him with an average income tax hike of $1,412. That’s over a quarter of their income.

This analysis does not include potential increases to property taxes in Evers’ proposed budget.