The DWD is picking winners and losers. Meddling with the market and subsidizing industry puts cronyism on full display.

Mar. 21, 2024

By Michael Lucas

The Wisconsin Department of Workforce Development (DWD) announced nearly $4 million in Wisconsin Fast Forward worker training grants. The DWD report touts that this investment is “sustaining Wisconsin’s robust economy and strengthening our state’s workforce now and into the future.” But did any of the folks at the DWD ever wonder why this “investment” was necessary? And did anyone wonder who these grants are really benefiting?

The “Official” Purpose of the Grants

DWD states in their memo that the intent of the grant money is to “reimburse costs associated with occupational training” to assist participants in gaining “opportunities for employment, higher-level employment, or increased wages.”

As per the requirements, for a group to receive grant funding, 85% of trainees must complete training, 65% must have a “gain” in employment (receive more working hours) and 75% of incumbent trainees (those already employed) must receive pay raises.

There is, of course, no stipulation as to how many more working hours trainees must receive, nor how much the pay increase must be.

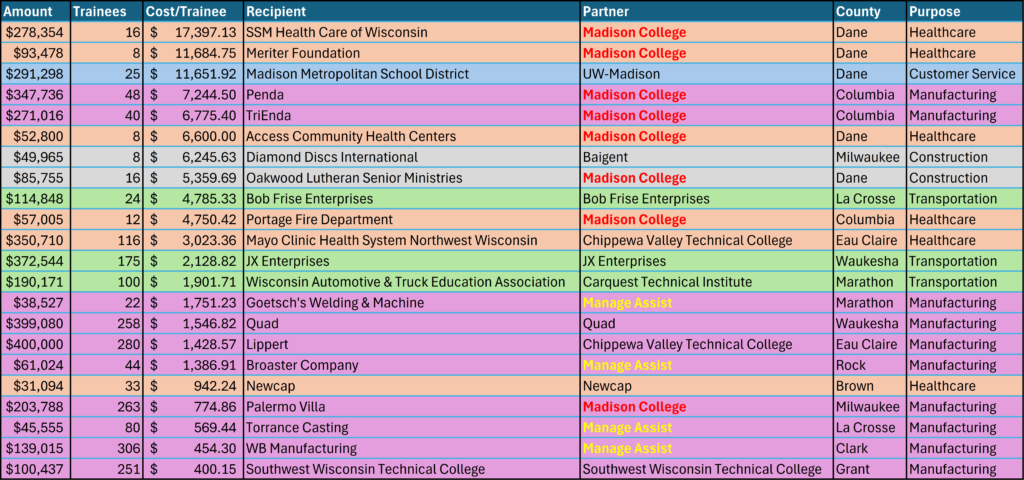

Who Got the Money

Recipients of the grant money were overwhelmingly in the Manufacturing (10 of 22) and Healthcare (6 of 22) industries. Manufacturing grants awarded averaged $200,000 and accounted for $2 million (50%) of the total grant money. The average cost per trainee comes out to $2,289.

In Healthcare, grants awarded averaged $143,907 and account for $863,441 (21%) of the total grant money. The average cost per trainee in this industry comes out to $7,558.

No doubt the recipients and employees are happy to have had their continuing education costs subsidized by the taxpayer, but they are nowhere near as happy as the real winners of the grant money.

Who Really Got the Money

A quick look at the DWD memo reveals an obvious pattern. On the one hand, manufacturing and healthcare are obviously favored industries. On the other hand, these grant recipients tend to partner with a particular institution over and over again. The big winner in this subsidy scheme, amassing a total compensation of $1,389,932, is none other than Madison College.

In fact, four of the five most expensive grants in terms of cost per trainee have all been awarded to Madison College, and all five are public colleges. What’s more, 7 of the 10 most expensive grants on a per trainee basis were awarded to Madison College, and 8 of the 10 are all public institutions of higher learning.

Compared to Manage Assist, a private training firm that delivers on-site training in manufacturing-related skills, Madison College is consistently beat-out by Manage Assist in Manufacturing training. On average, Madison College training costs per trainee amount to $7,573 compared to Manage Assist’s $1,040—more than seven times the cost.

Many reasons can be given for the vast discrepancy in cost per trainee, but these reasons wouldn’t go much beyond the realm of speculation. The most that can be said is that location is not a factor. Recipients who partnered with Madison College were all located in Dane, Columbia and Milwaukee counties, two of which are contiguous; Manage Assist served Clark, La Crosse, Rock and Marathon, two of which are contiguous.

The (Dis)Honorable Mention

Topping the list at number three, Madison Metropolitan School District won $291,000 to fund continuing education for 25 public school district employees. At a cost of $11,651 per person, these 25 people will have the attainment of their master’s degrees subsidized by the average Wisconsinite who makes $57,000 per year.

The DWD memo states that “Trainees will earn a master’s degree in education leadership to become assistant principals and principals.” Why? Because the average high school teacher in the Milwaukee public school district only makes $68,868 and $18,317 in fringe benefits, while the average elementary school teacher in the district only makes $69,611 and $20,259 in fringe benefits. Clearly, they can’t afford to pay for school and need to extort the money from poorer people.

The Economics of Subsidies

The economic effects of subsidies are well-established but little known. People often get the impression that the president, governor or government, in general, run the economy. In a market economy this is unequivocally false. Economies are run by distinct individuals pursuing their separate interests.

Consider the following: Individuals equip themselves with skills, enter the labor market, and are then employed by entrepreneurs. Entrepreneurs are in the business of creating value for consumers by mixing and arranging resources (natural resources, produced goods, labor and capital) in unique and economical ways. If the entrepreneur is successful in providing consumers with products that are cheaper or that they like more, he is rewarded with profits. Insofar as he fails to do this, he is burdened with losses.

If an entrepreneur finds that his income does not reflect what he believes the true valuation of his product is, he innovates; he changes his plan. If, for example, he manages a factory, this innovation can take the form of improving the production process. This could entail the addition or elimination of a machine, worker or ingredient. If upon reviewing his production process he finds no issue, he may turn to advertising or to workforce training, or some other aspect of his business.

If, later, he discovers that his employees are inadequately trained, he looks for better employees or improves the ones he has. If skilled labor happens to be especially scarce, he will resort to training his employees to increase their productivity. So long as the cost of doing so is less than the additional revenue he expects to earn, he will pursue this activity.

If he decides upon this course of action and has the capital to see it through, and if a sufficient portion of his workers successfully complete the training regimen such that he earns additional profits, then his use of resources in this way is correct. He is proven correct by the fact that consumers reward him with profits. They have, in essence, told him that they approve of the way he runs his business. He thus retains his position as the manager of not only a factory, but of those scarce resources which consumers want utilized.

But imagine now that the situation is the reverse: the entrepreneur expends capital to train his employees but suffers losses. In this case consumers signal to him that this activity is wrongheaded—he has utilized resources in such a way that he has destroyed value. These resources could have been put to better use elsewhere, but as a result of his mistaken beliefs, they have been put to use in a plan that is worth less than the alternative.

Now that we’ve established what occurs in a free and open market, consider what a subsidy does: a subsidy tells the recipient to ignore the desires of consumers. In a free market, consumers relay their desires via prices. But subsidies ignore prices. Subsidies tell the recipient that the cost of A is not $X but rather $X-Y or, often, $0. And at a reduced price, we know that people will consume more. In the context of this essay, these grant recipients receive a reduced price for consumer education and training services. They will, thus, overconsume these services at the expense of everyone else.

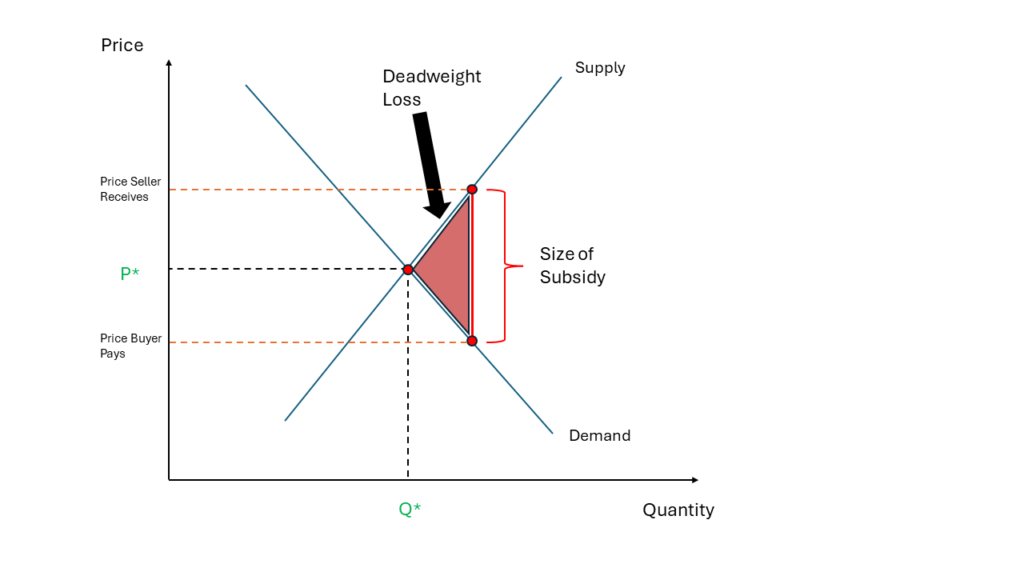

Graphically, the effects of a subsidy look like this:

When a subsidy is given a few things happen as a result: first, the seller receives a higher price for their product; and second, the buyer pays a lower price. The most important part of this analysis is the red triangle. It represents the deadweight loss caused by the subsidy. A deadweight loss is when trades do not occur that otherwise would, or when trades do occur that otherwise wouldn’t. In the case of subsidies, trades occur that otherwise wouldn’t.

Here’s how to interpret this graph: the demand curve represents the maximum willingness to pay for consumers. In other words, it shows you how much consumers value a good at any given quantity. The supply curve represents the minimum willingness to accept on the part of the sellers. In other words, it shows the cost of a good at any given quantity. When we force the market to conduct trades at quantities beyond equilibrium, we are forcing the sale of goods that cost more than they are valued. This is wasteful. In a free market without subsidies, trades of this sort would be reflected as losses to the entrepreneur. But through the magic of interventionism, they appear to be good for the seller and the buyer.

But if this were true, why are our governments being so stingy? Why not tax and subsidize us into prosperity? Surely some nation would have figured this out by now if the idea had any merit. But of course, it does not. Because what is unseen in all of this is that the subsidy is financed via taxation. Where in some markets we are beyond equilibrium, in others we are beneath. By artificially stimulating one market we must necessarily suppress another. Why? Because there is no such thing as a free lunch.

The Real Motivation for the Subsidy

No economist outside of an insane asylum genuinely believes that good ol’ fashioned ditch digging policies like the DWD’s grants actually create wealth. In reality, they create wealth for some at the expense of others. And if you’re making some people wealthy, and in all the right places, they just might reward you for it.

Pure and simple: The DWD is picking winners and losers. Meddling with the market and subsidizing industry puts cronyism on full display. With no economic rationale for this policy its only purpose can be to garner political support for the administration. By the time of the next gubernatorial, Evers can flaunt this “impressive” resume. At the very top he’ll list all the micromanaging and expenditures he authorized, claim any growth and innovation to be the product of his genius, and scapegoat his political enemies for any failures.

And if policies like this continue to be implemented, there will be many.