Troubled Common Ground CO-OP spent half of 20-year funding in one year alone

MacIver News Service | April 11, 2016

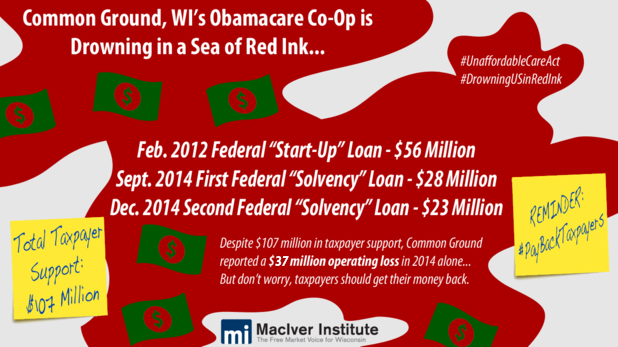

[Madison, Wis…] Wisconsin’s Obamacare CO-OP, Common Ground, is one of eight health insurance CO-OPs in the nation that will likely fail in 2016 because of its dire financial situation, according to a Daily Caller News Foundation (DCNF) analysis of the CO-OPs’ 2015 annual reports.According to The Daily Caller, Common Ground had $74 million in total assets in 2014. In that year alone, Common Ground reported $37 million in operating losses. Since its inception back in 2012, Common Ground has received over $107 million in taxpayer-supported loans and other funds. When originally passed, taxpayer financial support for the Obamacare co-ops was supposed to last 20 years.

In February testimony before Congress, Mandy Cohen, the Centers for Medicare and Medicaid Services’ (CMS) chief operating officer, indicated that eight CO-OPs would be in trouble this year. However, Cohen refused to identify which ones they were. DCNF’s analysis is the first to identify which eight CO-OPs are likely to close by the end of 2016.

CMS has two watch lists for troubled exchanges – those under enhanced oversight and those on a corrective action plan.

Based on its analysis of each CO-OP’s 2015 annual reports, DCNF determined which CO-OPs Cohen refused to specifically identify. According to their analysis, the CO-OPs in the worst financial trouble are those in Massachusetts, Oregon, Ohio, Connecticut, Montana, Illinois, New Mexico and Wisconsin.

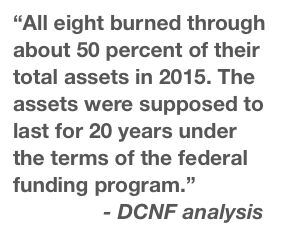

Like Common Ground, the other seven CO-OPs burned through around half their total assets, putting them in the worst financial shape of the 11 surviving Obamacare CO-OPs.

Common Ground finished 2014 with a $36.5 million deficit, according to a report from the Inspector General’s Office of the Department of Health and Human Services (HHS), as previously reported by the MacIver Institute.

The large net operating loss for Common Ground came despite their success in enrolling three times more people than projected. By the end of 2014, the CO-OP enrolled 26,000 when they expected only 10,000. Despite the enrollment numbers, Common Ground’s net income loss of $36.5 million in 2014 was $35 million more than expected.

To date, twelve of the original 23 CO-OPs have already shut down. Of the original 23, Wisconsin is one of only 11 that remain.

Read more of the Daily Caller’s analysis here.