July 14, 2023

By Bill Osmulski

Local governments took center stage throughout this year’s budget debate as they sought a massive increase in aid from state taxpayers.

The League of Wisconsin Municipalities, the Wisconsin Towns Association, and the Wisconsin Counties Association all pushed the narrative that Wisconsin’s current shared revenue system was “broken.” Under that system, the state allotted annual aid amounts in the state budget from the general fund. Local governments wanted a cut of the state’s sales tax revenue too.

It apparently doesn’t take much effort to convince government officials that government needs more money. Politicians on both sides of the aisle enthusiastically took up the cause. Just consider how willingly Democrat Gov. Tony Evers and Republican lawmakers collaborated to make it happen. They had a deal hammered out by early June, weeks before the Joint Committee on Finance was ready to take it up. The State of Wisconsin will now provide local governments with annual aid payments out of the general fund in addition to 20% of state sales tax revenue.

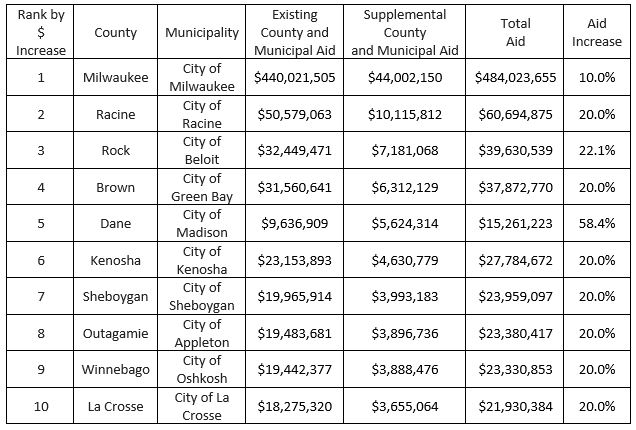

With the new budget now in effect, the Legislative Fiscal Bureau recently released new calculations of how much each town, municipality and county will receive through the shared revenue program. Last budget, they received a total of $1.4 billion in shared revenue from the general fund. That increased to $1.5 billion in this budget, plus they are projected to receive an additional $556 million in supplemental aid from the sales tax revenue. That’s a total increase of about 43%.

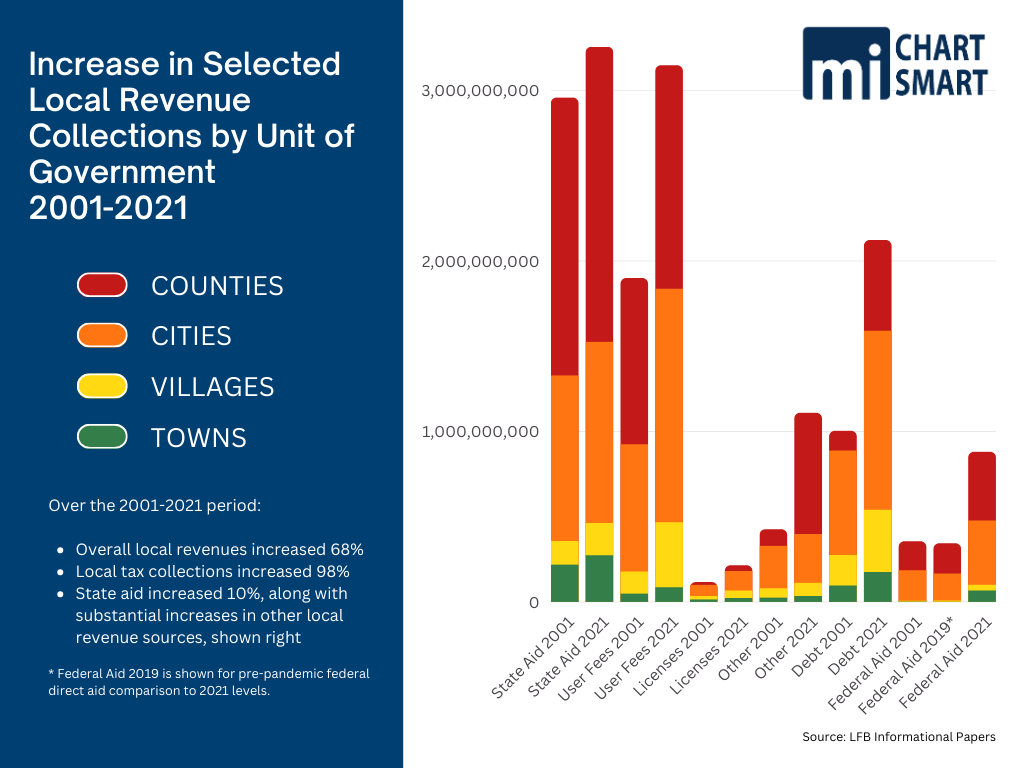

Remember – all of this new revenue coming from the taxpayer sits on top of the consistent spending increases local units of government in Wisconsin have been experiencing for years. Since 2001, expenditures of local governments have increased by 13% over the rate of inflation. Median household income in Wisconsin is outpacing inflation by only 3%.

Aid distributions are determined by a complex formula that ensures the cities of Milwaukee and Madison will get a minimum 10% in total aid, while everyone else gets a 20% minimum increase. Of course, some communities received far more than 20%. Here are the ten communities that received the largest dollar amount increases in aid over the next two years.

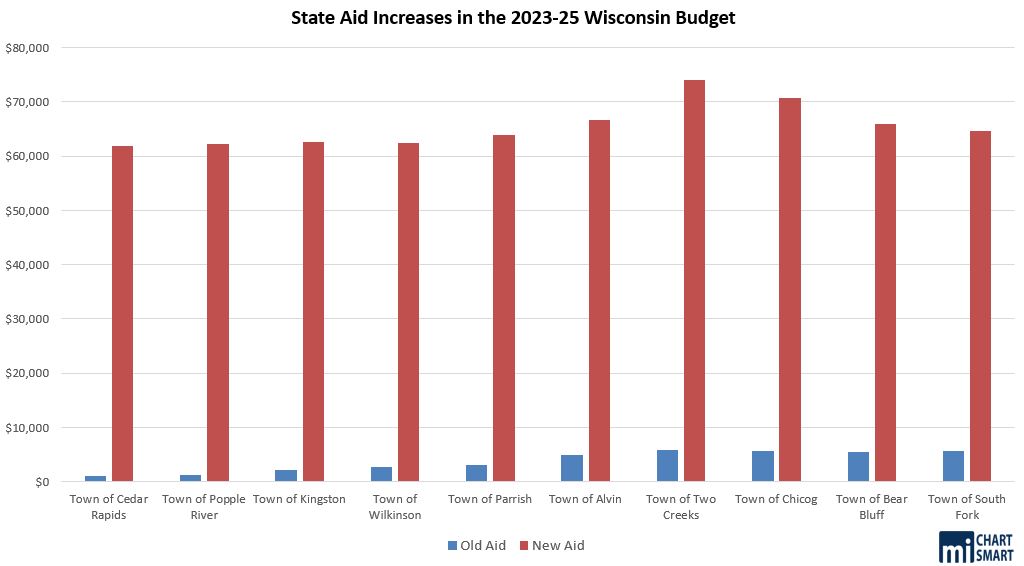

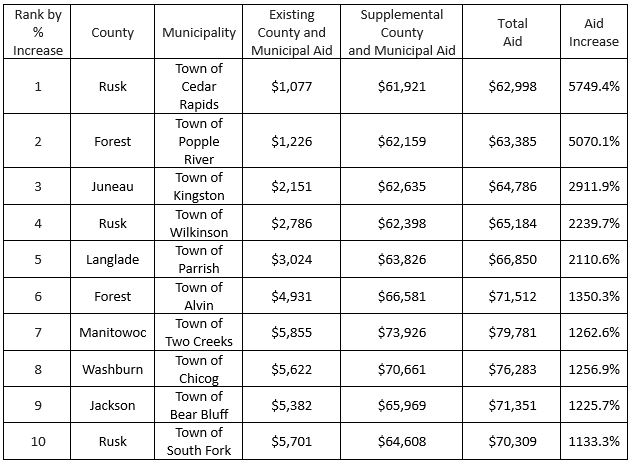

Here are the ten communities that received the largest percentage increases in aid.

Throughout the negotiations, the lobbyists waged an effective public relations campaign that hinged on keeping the focus solely on shared revenue. They didn’t want anyone talking about all the other aid that local governments receive from state and federal sources or the $5 billion they collect in property taxes every year. This provided essential cover to politicians who were blatantly prioritizing government spending over taxpayer relief.

Local governments also receive transportation aids, utility aids, tax exempt property aid, expenditure restraint aid, and property tax credit payments. This brings the total amount of state aid that local governments receive to well above $8.4 billion over the biennium. That does not include what schools get. Plus, they’ve received an additional $1.2 billion from the federal government over the past two years just from ARPA.

Oftentimes, the amount of aid a community receives dwarfs the amount of revenue it raises locally. This is especially true when it comes to the towns. Take Cedar Rapids in Rusk County for example. It has a population of 40 people and collected $4,002 in taxes in 2021. That year it received a total of $65,931 in aid from the state and federal governments. Out of its total revenue of $70,744 for the year, the town spent $12,829 on “general government.” Popple River in Forest County with a population of 42 collected $10,426 in taxes that year and received $253,146 in state and federal aid. $46,000 goes to “general government.”

“General government” is the term used by the Wisconsin Department of Revenue to track local finances. This category is important to single out because it is expensive and you don’t get much for that money. General government expenses do not include law enforcement, fire, ambulance, roads, waste disposal, sanitation, health services, culture and education, parks and recreation, or conservation and development. And yet, towns, municipalities and counties spend a combined $1.8 billion a year on “general government.”

In 2021, all local governments (excluding school districts) in Wisconsin combined received $3.79 billion in state and federal aid, and their total general revenue was $12.9 billion. That means they spent 14% of their revenue on “general government,” and 29% of their revenue came from the state or federal government.

The new state budget ensures that those numbers will continue to grow to the great benefit of government officials, at the expense Wisconsin taxpayers.