How K-12 school districts use high deductible health plans to control costs for taxpayers

August 28, 2018

By Ola Lisowski

Thanks to 2011’s Act 10, the market for government healthcare in Wisconsin has radically changed. As the MacIver Institute previously reported, public school districts in Wisconsin have saved $3.2 billion on benefits costs alone since 2010.

38 percent of Wisconsin’s 422 public school districts offer high deductible health plans for their employees. Plans are often coupled with health savings accounts, which use tax incentives to encourage individuals to save up for their own health care expenses.

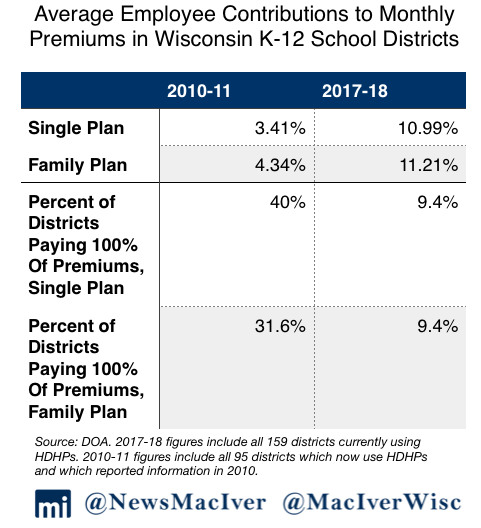

The majority of school districts found taxpayer savings by raising the required monthly premium contributions for employees. Many districts opened up bidding to new insurers for the first time in years, utilizing the competition of market forces that had long been closed off because of collective bargaining. In the 2010-11 school year, on average, districts paid upwards of 95 percent of employees’ premiums, totaling thousands of dollars per employee every month. That figure alone trended upwards in an unsustainable direction, crowding out other spending. New data from the 2017-18 school year show that school districts have taken advantage of the tools given to them by Act 10, providing more customizable, localized plans to the benefit of both employees and taxpayers.

One major innovation that has sprung up since Act 10’s passage comes in the form of high deductible health care plans. Rather than using traditional plans where the employer – in this case, taxpayers – picks up the vast majority of employee health care costs, high deductible health plans (HDHPs) are an increasingly popular way for districts to keep costs down.

Today, 38 percent of Wisconsin’s 422 public school districts use these plans, often coupled with health savings accounts (HSAs), to lower costs to taxpayers. Both HDHPs and HSAs are an increasingly popular form of consumer-driven health care, offering more choice for individuals in how they want to spend on health care costs.

Today, 38 percent of Wisconsin’s 422 public school districts use these plans, often coupled with health savings accounts (HSAs), to lower costs to taxpayers. Both HDHPs and HSAs are an increasingly popular form of consumer-driven health care, offering more choice for individuals in how they want to spend on health care costs.

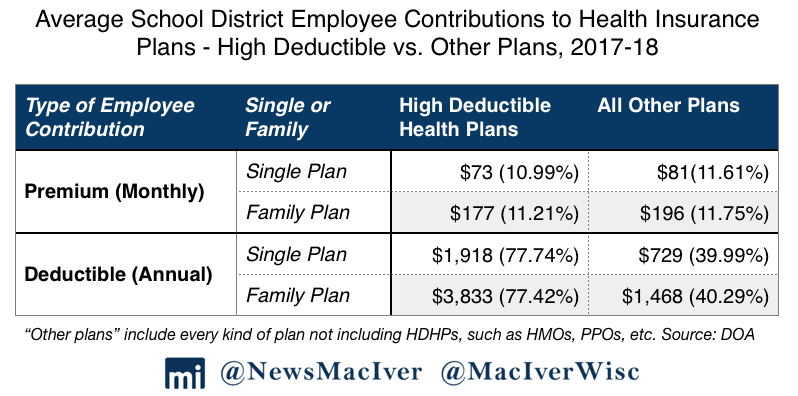

Among the districts using HDHPs, employee contributions to monthly premiums average 10.99 percent or $73 on single plans, and 11.21 percent or $177 on family plans.

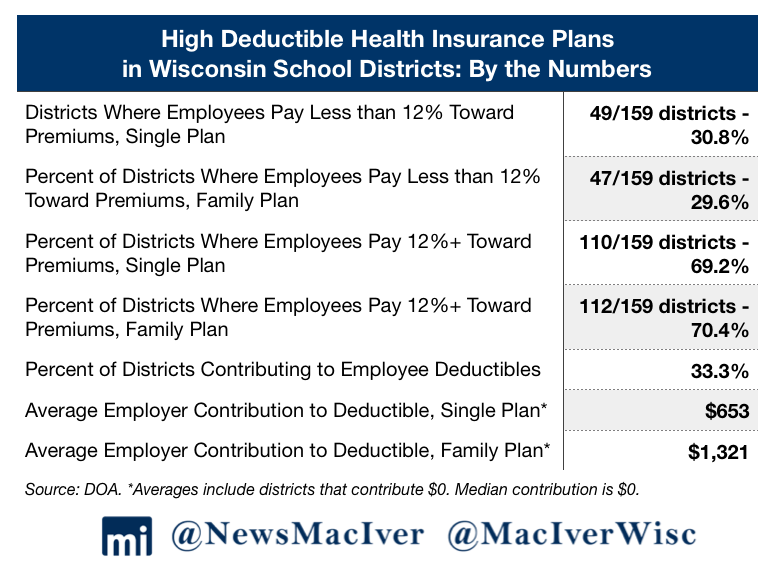

In 69 percent of districts using HDHPs, employees pay 12 percent or more toward premiums on single plans. That number increases to 70 percent for family plans. Under Act 10, employees must pay a minimum of 12 percent toward all health care costs. Fewer than one-third of districts require employees to pay less than 12 percent toward their premiums, including 9 percent where employees contribute zero percent to premiums on both single and family plans.

Across the country HDHPs have become more common in recent years. An estimated 21 million Americans used HDHPs and HSAs in 2017 – a 9.2 percent increase over the prior year. A National Institutes of Health analysis showed that HDHP usage grew significantly between 2016 and 2017 across various industries, including education, health care, retail, and manufacturing, with education showing the largest percentage increase.

These types of plans have been lauded for getting employees more invested in their own care. Tax incentives around HSAs also encourage individuals to set aside money over time for health care expenses. Money put into an HSA, through a bank or other similar organization, “moves” with the individual through their lifetime, regardless of where they work.

In 2018, those on family plans can contribute up to $6,900 into HSAs, while those on single plans can contribute up to $3,450. Those contributions, up to $6,900 or $3,450, are tax deductible – meaning individuals can write the amount off on their taxes. That money goes into an HSA to be used only for qualified health care expenses. Individuals can also choose to invest the money, making the plan benefits akin to a 401k. In that way, individuals can slowly build up a nest egg for health care expenses while being rewarded on their tax filings each year.

However, even on HDHPs, many employers also contribute toward their employees’ deductibles and HSAs.

Nearly two thirds – 61 percent – of districts contribute to single HSA plans, and 62 percent contribute to family HSA plans. Of those who do contribute to HSAs, the average annual contribution is $311 on a family plan, or $163 on a single plan. Taxpayers in Beloit Turner School District are the most generous, paying $4,266 for each employee’s annual family HSA, or half of that amount on single plans.

At the same time, 67 percent of districts do not contribute toward employee deductibles, the most common out-of-pocket expense. Of the districts that do not contribute anything, the average total deductible is $2,247 on a single plan or $4,521 on a family plan. The maximum deductible in that category is in White Lake, where employees pay the entirety of their own annual deductibles, totaling $5,050 on a single plan and $10,100 on a family plan.

On average, among districts using HDHPs, employees pay 78 percent of their deductibles on both single and family plans. Just five districts pay the entire amount of their employee deductibles on family plans, and six districts pay the full cost on single plans. Taxpaying residents of the school districts of Dover #1, Brodhead, Norwalk Ontario Milton, Bangor, and Spencer pay employee deductibles in full, ranging from $3,000 to $10,000 for family plans and $1,500 to $5,000 on single plans.

Even if employees do not contribute toward their own monthly premiums, overall health costs can decrease as a result of employees considering their own health spending more carefully.

In Wauwatosa School District, for example, monthly premium costs have fallen by 0.32 percent since 2010. District employees do not contribute toward their own premiums, instead paying the entirety of their annual deductibles – $1,300 on a single plan or $2,600 on a family plan. All told, employees are now paying a minimum of 12 percent toward their health care expenses, according to the district’s business director.

Prior to Act 10, employees paid 3 percent toward monthly premiums, making Wauwatosa School District an anomaly in that the district actually lowered required premium contributions for employees. The vast majority of districts went in the other direction, with most moving toward 12 percent employee contributions to premiums to ensure that they’d comply with Act 10’s intent.

Across all sectors, American consumers are now contributing approximately 30 percent of their own health care expenses, with employers picking up about 70 percent. That’s a shift away from the 80/20 split which had long dominated the market. As employees take on more of the costs of their own health care, employers are increasingly offering wellness incentives and benefits, as well as on-site clinics for employees.

The same trend is reflected in the new K-12 employee health care figures. As MacIver previously reported, many of Wisconsin’s public school districts offer some kind of wellness incentive or premium reduction for completing annual physical exams. At least two dozen districts offering such incentives use HDHPs for their employees. Others, still, have their own on-site clinics where employees can go for little or no cost.

Waukesha School District, for example, has shared an employee clinic with the City of Waukesha and Waukesha County since late 2014. Clinic visits are $25 for employees, while prescription fills are just $2 per bottle. Visits to Eau Claire Area’s near-site clinic come at no cost to employees.

Of the districts now on HDHPs and that reported their insurance plans to the state in 2010, 88 percent have raised monthly premiums or kept them the same for employees on single plans. A handful of districts do not require their employees to contribute anything toward premiums on single plans, including Burlington Area, Cumberland, Lac du Flambeau #1, New Berlin, and St. Croix Central. For family plans, 92 percent of districts have raised employee premium contributions since 2010.

Districts using HDHPs are more likely to offer multiple plans than school districts in general. While 53 percent of districts offering high deductible health plans provide numerous other plans, 39 percent of all districts do the same. The types of other plans vary widely by district.

Nearly three-quarters – 73 percent – of districts offering high deductible plans are traditional fully insured plans, meaning they provide insurance coverage through third party companies. The rest are split between self-insured plans (13 percent), where the district covers their employees’ health insurance claims themselves, and jointly self-funded plans (14 percent), a combination of the two.

With the American health care market rapidly changing, more Wisconsin school districts are using the freedom given to them by Act 10 to provide innovative benefits packages that more closely align with the private sector. Consumer-driven plans that offer wellness benefits and on-site clinics bring down overall costs even if employees are paying less than they might in other sectors. Contrary to the law’s critics gloom and doom predictions, the sky has not fallen in the post-Act 10 world.