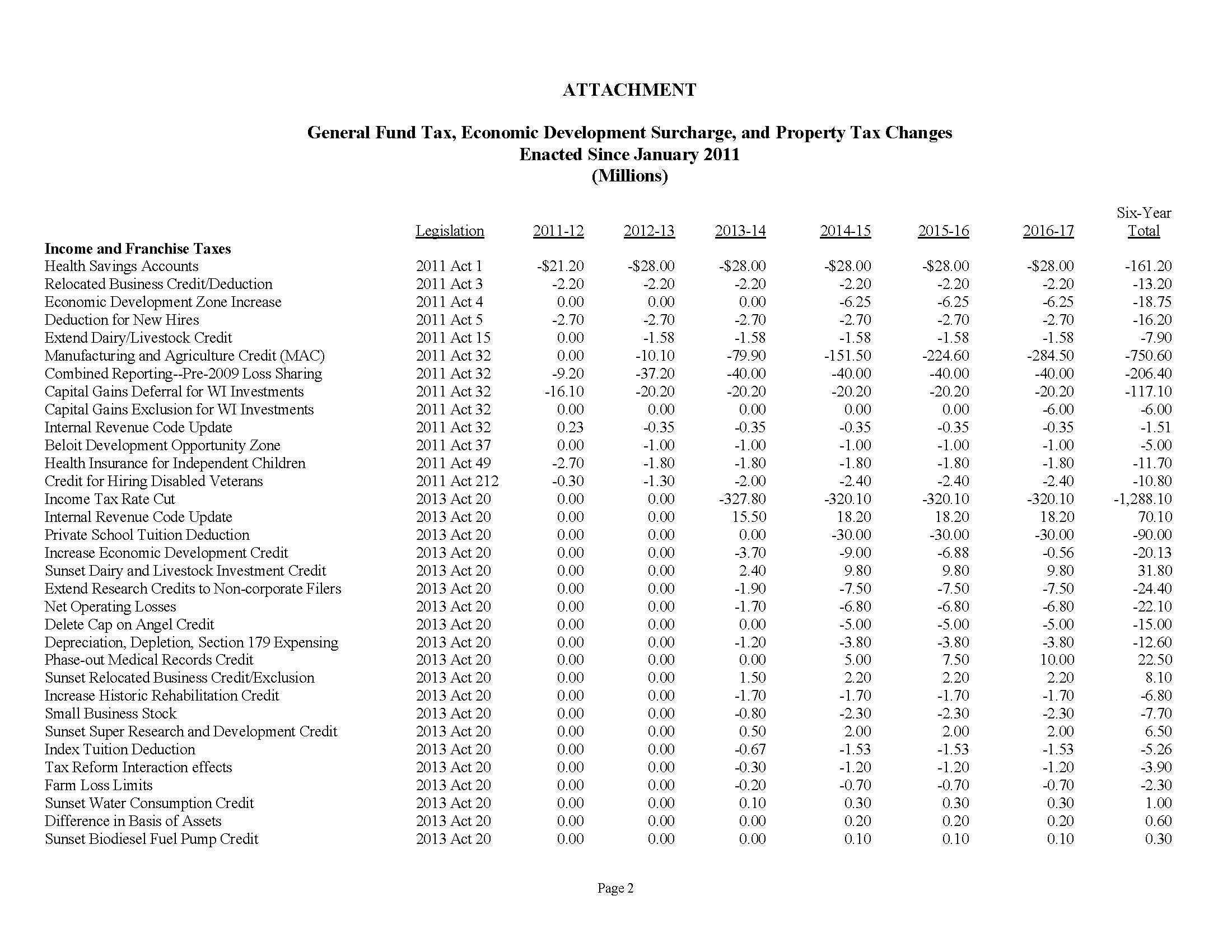

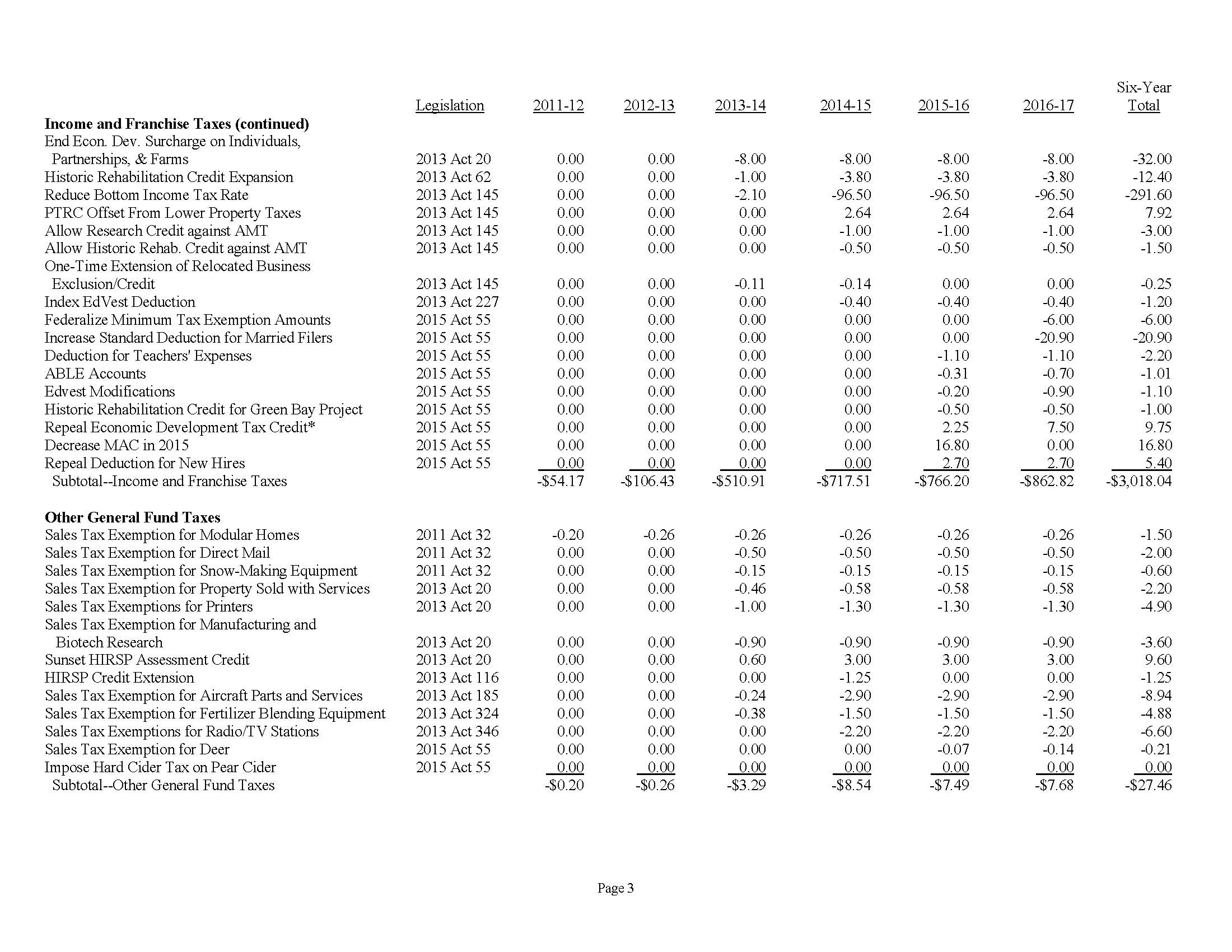

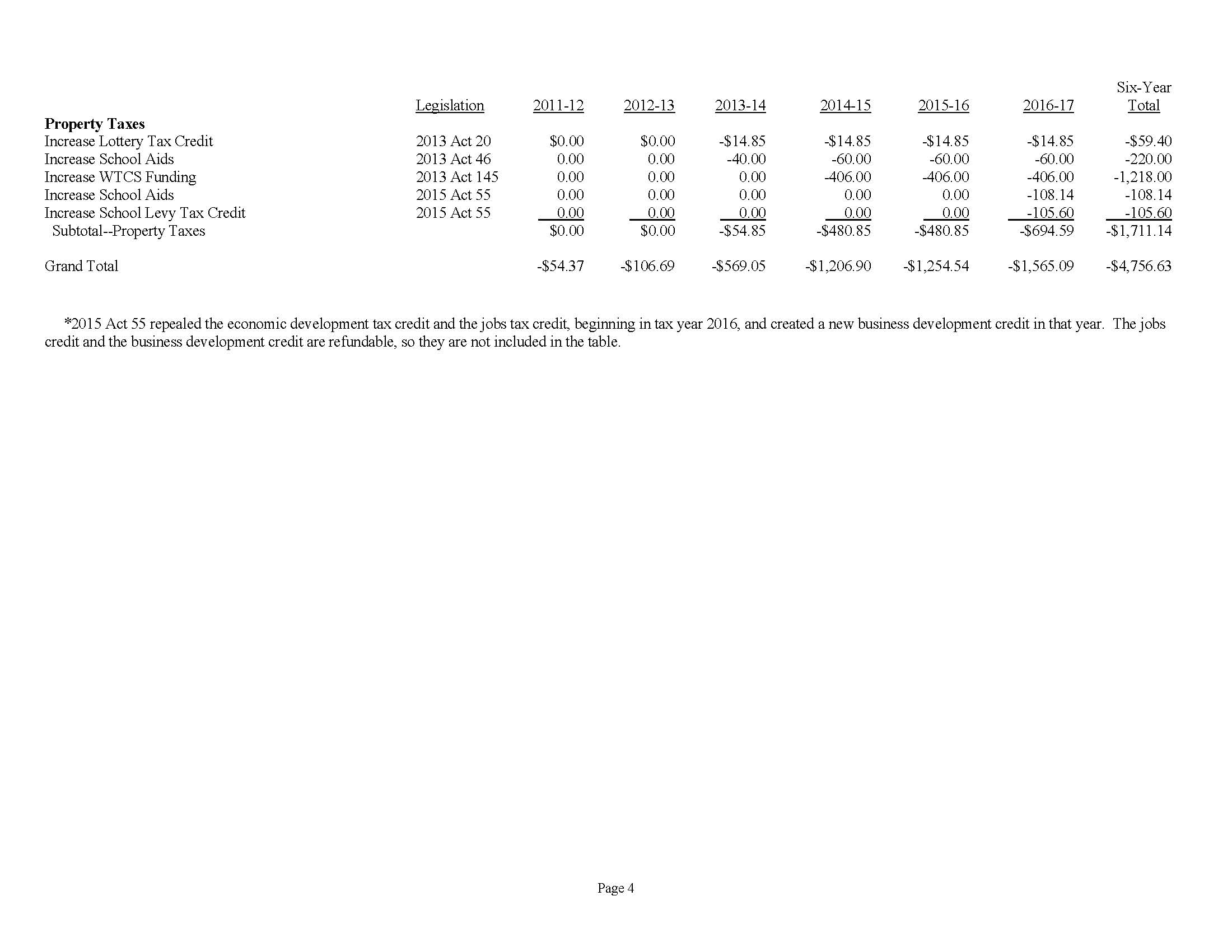

Wisconsinites have witnessed a nearly $5 billion total reduction in taxes since Gov. Walker took office, according to a Legislative Fiscal Bureau (LFB) memo requested by Sen. Scott Fitzgerald.

Over the course of six years and three biennial budgets, a wide variety of changes to Wisconsin tax laws have generated a total taxpayer savings of $4.756 billion, the LFB estimates. That includes 50 income and franchise tax changes totaling $3.018 billion in tax relief; 13 other general fund tax changes totaling $27.46 million; and five measures that target reducing property taxes, totaling $1.711 billion.

As noted in the memo, several of the tax law changes won’t take place until the 2017 fiscal year. The memo also refers to “revenue losses” – outside the halls of government, this can be interpreted as “taxpayer savings.”

To make this information readily available to the public, we’ve included the LFB memo below. You can also download the memo here.